Tesla (TSLA) stock has long carried what many investors describe as an “Elon Musk premium”—a valuation uplift driven not just by vehicle sales or margins, but by faith in Musk’s broader vision of artificial intelligence, autonomy, robotics, and technological disruption. For years, buying TSLA has effectively been the only public-market way to gain exposure to Musk’s ambitions, spanning everything from robotaxis and humanoid robots to energy systems and beyond. But with SpaceX now reportedly moving closer to an initial public offering (IPO) next year, that exclusivity may be coming to an end—and it’s raising an uncomfortable question for Tesla shareholders.

The concern is straightforward: if SpaceX becomes public, investors would have a second vehicle for “Elon exposure,” offering access to rockets, Starlink, and even future space-based AI infrastructure. For some, that raises concerns that capital could rotate out of Tesla, pressuring TSLA shares as investors reassess how much of the company’s valuation is tied to Musk himself rather than Tesla’s standalone fundamentals.

As SpaceX’s IPO chatter grows louder, investors are left with a critical question: Will Tesla lose its so-called Musk premium? And more importantly, is this the moment to lock in gains? Let’s take a closer look!

About Tesla Stock

Tesla is a prominent innovator dedicated to accelerating the global transition to sustainable energy. The Elon Musk-led powerhouse designs, develops, manufactures, leases, and sells high-performance, fully electric vehicles, solar energy generation systems, and energy storage products. It also offers maintenance, installation, operation, charging, insurance, financial, and various other services related to its products. In addition, the company is increasingly focusing on products and services centered around AI, robotics, and automation. TSLA has a market cap of $1.6 trillion.

Shares of the EV maker have gained 23% on a year-to-date (YTD) basis. Last week, TSLA stock climbed to its first record high since last December, boosted by robotaxi optimism. The recent rally followed a post on X from Musk saying that Tesla was testing robotaxis without in-car safety monitors. This marked another step toward expanding the service across the U.S. Investors see robotaxis as a catalyst for a new phase of earnings growth for the company.

At the same time, the recent rally has left Tesla shares trading at very elevated valuations. At roughly 292 times forward earnings, the stock has the highest valuation in the S&P 500 ($SPX).

SpaceX Eyes Possible Record IPO

SpaceX appears poised for one of the largest IPOs in history. Last Sunday, The Wall Street Journal reported that SpaceX executives had begun the process of selecting Wall Street banks to advise on its IPO. Reuters recently reported that Morgan Stanley is emerging as a top contender for a key role in SpaceX’s IPO, with its close relationship with CEO Elon Musk giving the bank an advantage. However, the report said the IPO selection process, or “bake-off,” is still ongoing, involving a small group of banks including Morgan Stanley, Goldman Sachs, and J.P. Morgan. It noted there is no guarantee Morgan Stanley will land the coveted “lead left” underwriting role.

In an internal memo circulated in early December, SpaceX Chief Financial Officer Bret Johnsen told employees that the company was preparing for a public offering in 2026. “Whether it actually happens, when it happens, and at what valuation are still highly uncertain, but the thinking is that if we execute brilliantly and the markets cooperate, a public offering could raise a significant amount of capital,” Johnsen wrote.

Meanwhile, Bloomberg reported that SpaceX is aiming for a mid-to-late 2026 IPO that could raise around $30 billion and value the company at roughly $1.5 trillion. If SpaceX meets its IPO targets, it would eclipse Saudi Aramco as the largest stock market debut ever. Aramco raised roughly $29 billion in its 2019 IPO. Notably, SpaceX was reportedly considering an insider share sale that would value the company at $800 billion, making it the world’s most valuable privately held business.

Musk has long said he has little interest in taking SpaceX public, arguing that doing so could distract from his goal of advancing plans to colonize Mars. However, he and others have recently floated the idea that power shortages are limiting the AI boom and that placing data centers in space, where they could rely on solar energy, might be part of the solution. With that, SpaceX plans to use part of the IPO proceeds to develop space-based data centers, including buying the chips needed to run them, according to Bloomberg. The cash infusion could also allow the company to accelerate development of its new Starship rocket.

Will Tesla Stock Lose Its “Musk Premium” Once SpaceX Goes Public?

As SpaceX reportedly advances its IPO plans, investors are beginning to weigh what the move could mean for TSLA stock. Elon Musk is pitching investors a future built around driverless cars and humanoid robots, and for now, TSLA stock is the only way to buy into that vision. But what happens to the stock if investors seeking “Elon exposure” have another way to get it? Could TSLA stock lose its so-called “Musk Premium?”

Well, the first cohort of investors and analysts think so, arguing that a SpaceX IPO could create some selling pressure on Tesla shares. “There are investors that own Tesla for exposure to Elon’s ideas and not for the car company attached to the ticker,” according to Dmitry Shlyapnikov, an analyst at Horizon Investments.

However, I totally disagree with this thesis. Musk has long argued that Tesla is far more than just a car company, and investors buy the stock largely for his AI ambitions (FSD, robotaxi, Optimus)—not simply for exposure to the auto business, which has been struggling this year. And the second key point is that SpaceX does not compete with Tesla in any way and instead complements it (as I’ll discuss later), so I see no fundamental reason for investors to sell TSLA shares once SpaceX goes public. Still, I acknowledge that SpaceX’s IPO could create temporary technical pressure on TSLA shares, as retail investors may sell the stock to free up cash and rotate into SpaceX. A clear example of this kind of speculative behavior was the launch of Donald Trump’s $TRUMP crypto token, when major cryptocurrencies sold off as investors freed up cash to chase the rally in $TRUMP.

There’s also a view that the SpaceX IPO would shine a brighter spotlight on Musk, potentially giving Tesla another boost in momentum. “Historically, when one of Musk’s companies achieves a major milestone, it tends to lift sentiment for the others. A high-profile SpaceX IPO could attract a fresh wave of investors who are drawn to his innovation story—and that enthusiasm often spills over into Tesla,” said Adam Sarhan, chief executive officer of 50 Park Investments. More importantly, the missions of Tesla and SpaceX are interconnected, with Tesla’s Optimus robots central to Elon Musk’s vision of colonizing Mars, while SpaceX’s Starlink strengthens vehicle connectivity on Earth. With that, I believe SpaceX’s IPO would ultimately be a positive catalyst for TSLA stock.

Finally, a SpaceX IPO could even draw in some current Tesla skeptics, giving them a way to buy into a piece of Musk’s vision without taking on Tesla’s perceived “baggage.” SpaceX’s Starlink satellite broadband business, with more than eight million customers, offers strong growth potential. According to Bloomberg, the company is projected to generate about $15 billion in revenue in 2025, rising to roughly $22-$24 billion in 2026, with most of that coming from Starlink. “Commercial Starlink is by far our largest contributor to revenue,” Musk said in a post on X in early December. And keep in mind that SpaceX controls roughly 80% of the global launch market. Its Falcon 9 and Falcon Heavy rockets have achieved high flight rates.

What Do Analysts Expect for TSLA Stock?

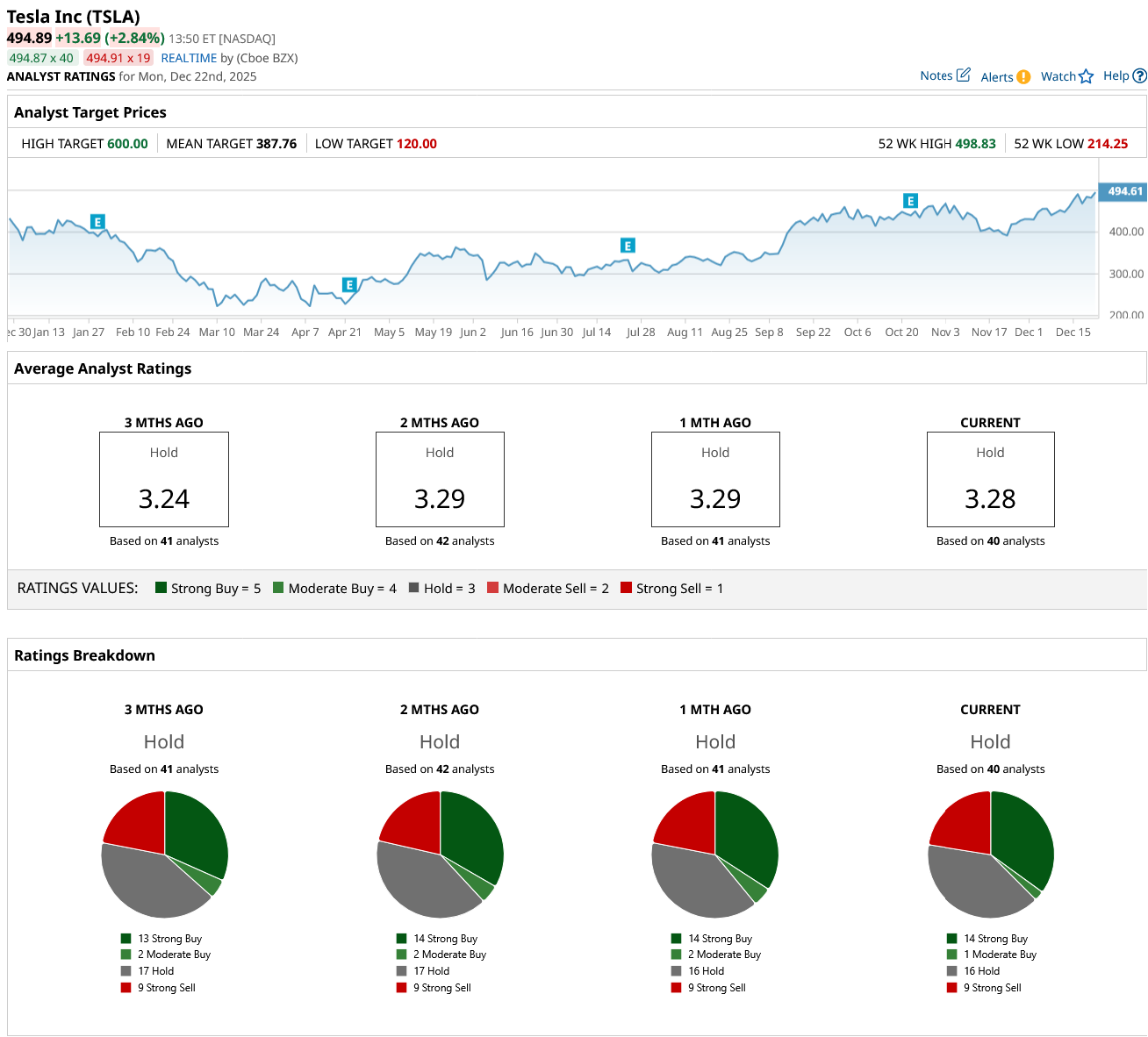

Wall Street analysts remain divided on TSLA stock. Among the 40 analysts covering the stock, 14 rate it a “Strong Buy” and one assigns a “Moderate Buy” rating, while 16 recommend holding and nine have a “Strong Sell” rating. This translates to a consensus rating of “Hold.” TSLA stock currently trades well above its mean price target of $387.76, though it still offers solid upside potential to the Street-high target of $600.

Putting it all together, I don’t believe TSLA stock will lose its “Elon Musk Premium” after the SpaceX IPO, and I expect the offering to ultimately be a positive catalyst for TSLA shares. Instead, the key issue TSLA investors should weigh when deciding whether to sell the stock is its extreme valuation. At current levels, the stock appears priced for perfection, warranting caution, especially ahead of two risk events: Tesla’s fourth-quarter delivery update in early January and its earnings report scheduled for late January.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Bad News for This Michael Burry Stock Pick?

- Analysts Are Betting Big on Rivian Stock Ahead of 2026. Should You Get In on RIVN Here Too?

- DraftKings Just Launched Its Prediction Market App. Should You Make a Bet on DKNG Stock Here?

- Dear Opendoor Stock Fans, Mark Your Calendars for December 22