Ecolab Inc. (ECL) is a global provider of water, hygiene, and infection prevention products and services, serving commercial, industrial, and institutional customers around the world. Headquartered in Saint Paul, Minnesota, the company operates across key segments, including Global Industrial, Global Institutional & Specialty, Global Healthcare & Life Sciences, and Global Pest Elimination, helping clients improve operational efficiency, safety, and sustainability. Ecolab’s market cap is around $78.6 billion, reflecting its position as a large-cap specialty chemicals and services firm with extensive international reach.

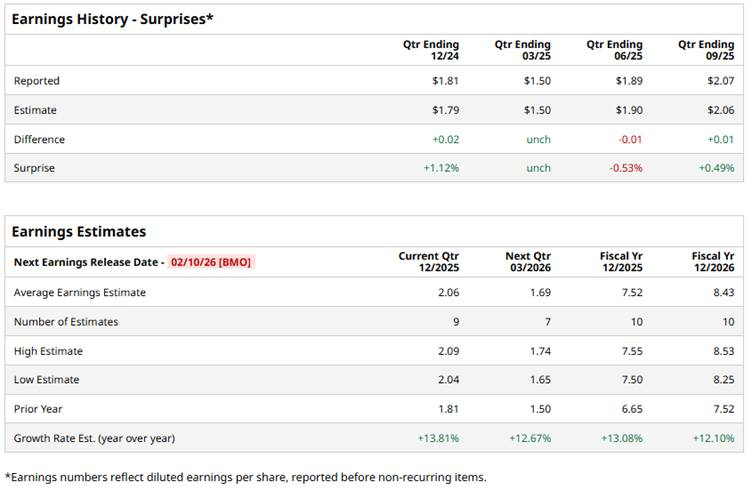

The company is slated to announce its fiscal Q4 2025 earnings results before market open on Feb. 10. Ahead of this event, analysts expect Ecolab to report an EPS of $2.06, a 13.8% rise from $1.81 in the year-ago quarter. It has exceeded or met Wall Street’s earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts forecast the company to report EPS of $7.52, marking an increase of 13.1% from $6.65 in fiscal 2024. In addition, its EPS is anticipated to grow 12.1% year-over-year to $8.43 in fiscal 2026.

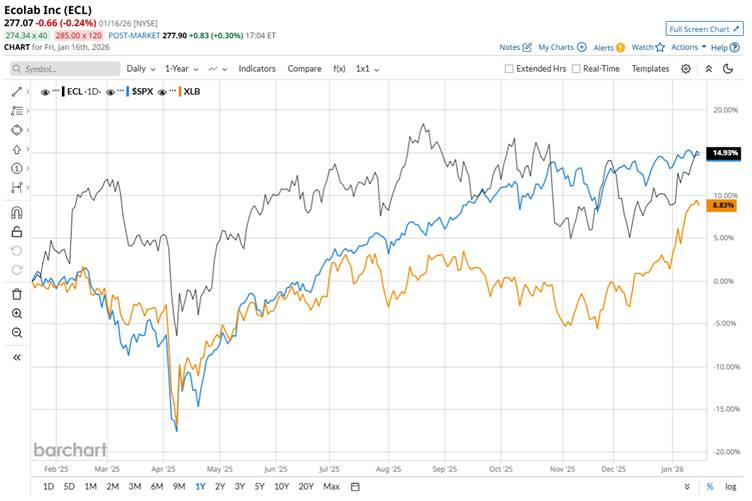

Shares of Ecolab have risen 15.9% over the past 52 weeks, underperforming the broader S&P 500 Index’s ($SPX) 16.9% return. However, the stock has outpaced the State Street Materials Select Sector SPDR ETF’s (XLB) 10.9% rise over the same time frame.

Ecolab’s stock has seen a stable run because investors are encouraged by the company’s consistent double-digit earnings growth and strong outlook. In the third quarter of fiscal 2025, Ecolab reported net sales growth of 4% year-over-year to $4.2 billion, while organic sales grew 3%.

Plus, Ecolab delivered adjusted EPS of $2.07, representing around 13% growth compared to the prior year and slightly beating estimates. Additionally, moves like a 12% dividend increase in December 2025 boosted optimism.

Analysts’ consensus view on ECL is cautiously optimistic, with an overall “Moderate Buy” rating. Among 27 analysts covering the stock, 13 suggest a “Strong Buy,” two give a “Moderate Buy,” and 12 recommend a “Hold.” The average analyst price target for ECL is $295.20, indicating a potential upside of 6.5% from the current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart