Alphabet (GOOG) (GOOGL), the parent company of Google, didn’t just come to the spotlight because of artificial intelligence (AI). In fact, Google has been using AI and machine learning long before AI skyrocketed to mainstream prominence. Although AI has boosted Alphabet’s game, the company is built on exceptionally strong fundamentals. It achieved double-digit revenue growth due to its Search dominance, generated significant free cash flow, and maintained operating margins that surpassed most large-cap peers.

GOOGL stock has returned over 774% over the last decade. It surged 70% last year, wildly outperforming the broader market, and I believe it still has plenty of room to run over the next decade.

What Went Right With Alphabet?

AI’s story with Google began back in 2017. Alphabet had already embedded AI into Gmail, which helped how emails were organized, filtered, and prioritized through features such as Smart Reply and Smart Compose, advanced spam filtering, and much more. Google Search remains the top search engine, accounting for 90.8% of the market share. This type of hold has provided Alphabet a competitive advantage in the market, resulting in revenue rising from $182 billion in fiscal 2020 to a projected $400 billion in fiscal 2025.

In fact, the company reported its first-ever $100 billion-plus quarter in the recent third quarter of fiscal 2025. Total revenue of $102.3 billion increased 16% year-over-year (YoY), led by growth in almost every segment. Net earnings surged 35% YoY to $2.87 per share, owing to solid operating leverage despite the company's significant AI investments.

Besides Search, Google Cloud is another profit-generating segment. Cloud’s revenue rose 34% to $15.2 billion, pushing operating margin to 23.7%. Alphabet is signing more customers, making larger deals, and developing deeper ties, with over 70% of existing Cloud customers now adopting its AI products. Cloud backlog now stands at $155 billion, driven primarily by enterprise AI demand.

YouTube remains another success story. Advertising revenue on YouTube grew 15%, driven by both direct response and brand spending. The company believes that new tools powered by generative AI could boost YouTube's long-term monetization potential.

AI as a Full-Stack Advantage

During the Q3 earnings call, CEO Sundar Pichai attributed the company's success to a full-stack AI strategy. Alphabet has now integrated AI into every corner of its business. AI is driving higher engagement and query growth for Search fueled by AI Overviews and AI Mode. AI Mode alone now has over 75 million daily active users. In Q3, Search and other advertising revenue grew 15% YoY to $56.6 billion, accounting for 55% of total revenue. Alphabet is also the leading company in advertising, a market that is poised to be worth $1.3 trillion by 2027.

On the infrastructure front, Alphabet has been rapidly expanding, delivering both leading Nvidia GPUs and its Tensor Processing Units (TPUs). Ironwood, the company's seventh-generation TPU, could be accessible to the public soon. Meanwhile, demand continues to rise as Anthropic, an AI research startup, wants to access up to 1 million TPUs. On the research front, management emphasized that over 13 million developers are working with Alphabet's generative models, including Gemini 2.5 Pro, Veo, Genie 3, and others. Alphabet intends to continue spending extensively on AI while competitors Microsoft (MSFT), Amazon (AMZN), and Meta Platforms (META) up the stakes in the AI game. Capital expenditures totaled $24 billion in Q3, and management forecasts full-year capital expenditures to be between $91 billion and $93 billion, reflecting sustained demand for AI infrastructure.

Despite these massive investments, Alphabet is financially sound to continue investing aggressively while still returning capital to shareholders through buybacks and dividends. It generated $24.5 billion in free cash flow in Q3 and $73.6 billion over the past 12 months. Furthermore, it ended the quarter with $98.5 billion in cash and marketable securities.

What Are Analysts Saying About GOOGL Stock?

Analysts expect Alphabet’s revenue to increase 14.3% in fiscal 2025 to $400.2 billion, followed by an earnings increase of 31.3% to $10.56 per share.

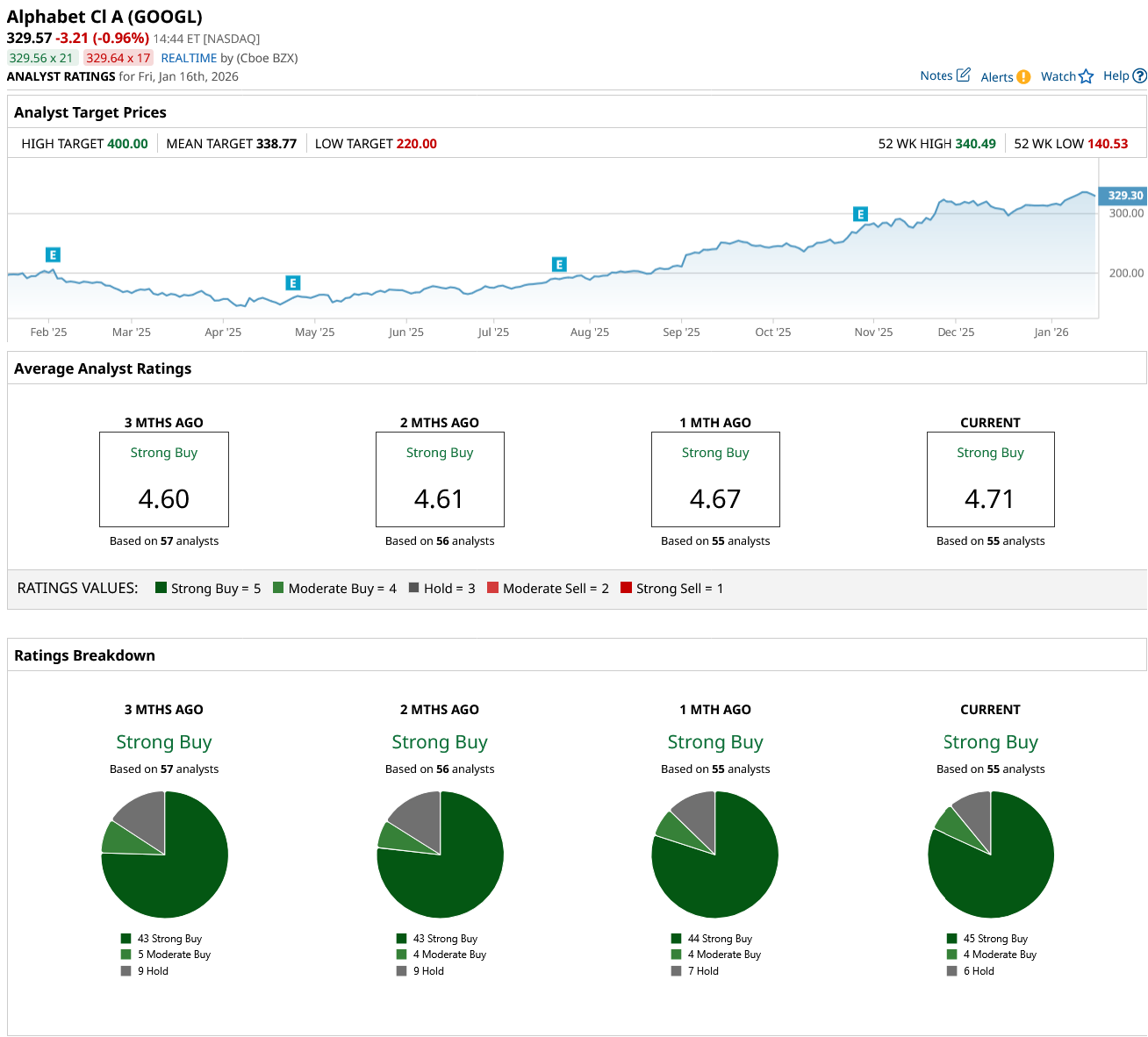

Overall, analysts rate GOOGL stock a “Strong Buy.” Recently, Goldman Sachs increased the target price to $375 from $330, keeping their “Buy” rating for the stock.

Out of the 55 analysts covering GOOGL stock, 45 have a “Strong Buy” recommendation, four recommend “Moderate Buy,” and six rate it a “Hold.” The stock has no sell recommendations. Based on analysts' average price target of $338.77, Wall Street sees a potential upside of about 1.8% in the next 12 months. Plus, its high price estimate of $400 suggests the stock can climb by 20.2% from current levels.

Alphabet is growing faster than ever before, monetizing AI across its core products and making ambitious investments for the future. What’s impressive is the company is doing all this while delivering record profits and cash flow, which is why if I had to buy one stock now, GOOGL would be it.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Want to Invest in Nvidia’s Futuristic Rubin Chips? Consider This 1 ‘Picks-and-Shovels’ Stock Instead.

- Microsoft Wants to Lower Data Center Energy Use. Does That Help the Bull Case for MSFT Stock?

- Trump Is Taking Aim at Credit Card Swipe Fees. Should You Ditch Visa Stock ASAP?

- Dear Apple Stock Fans, Mark Your Calendars for January 27