Fundamentally, the corn market is the more bullish of the five major grain markets.

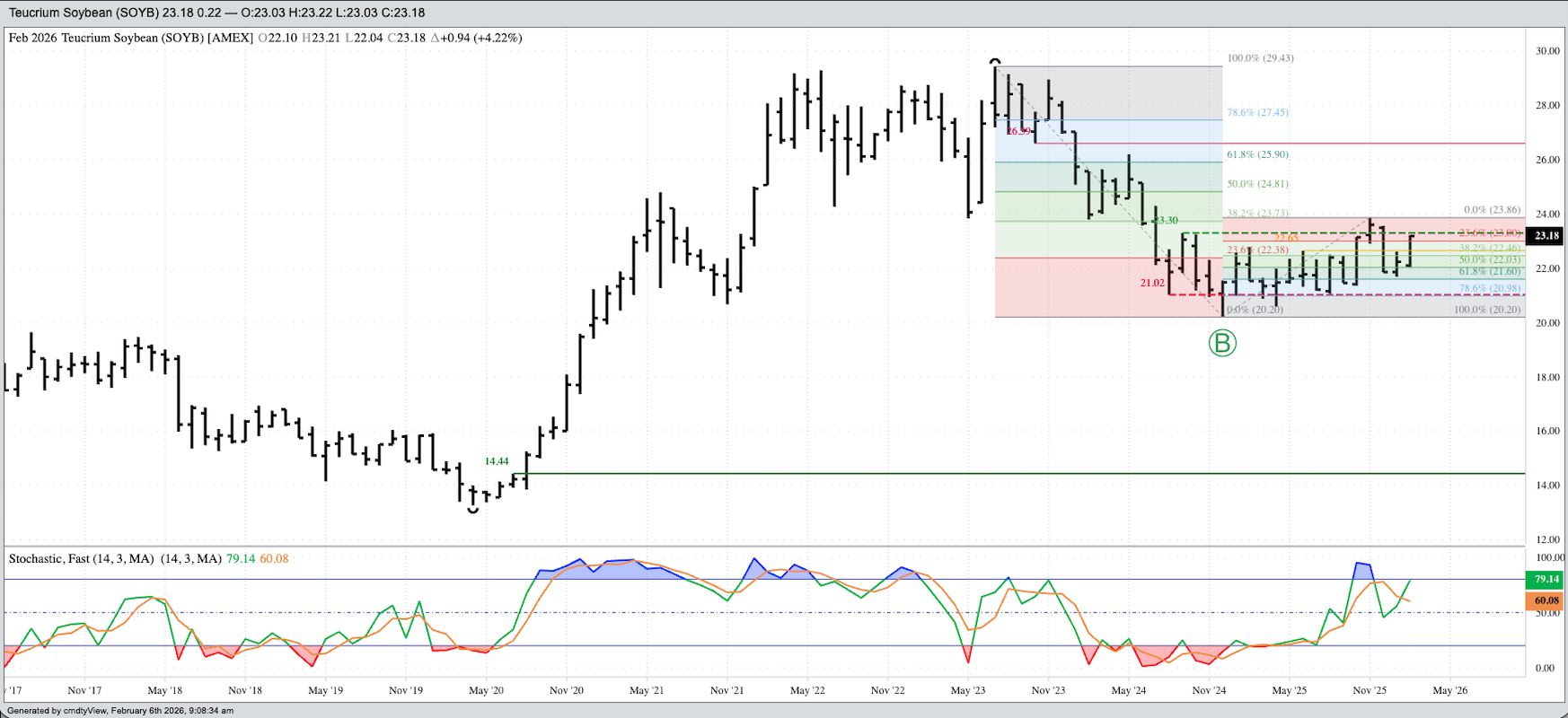

Technically, soybeans continue to benefit from politically driven misinformation posted to social media.

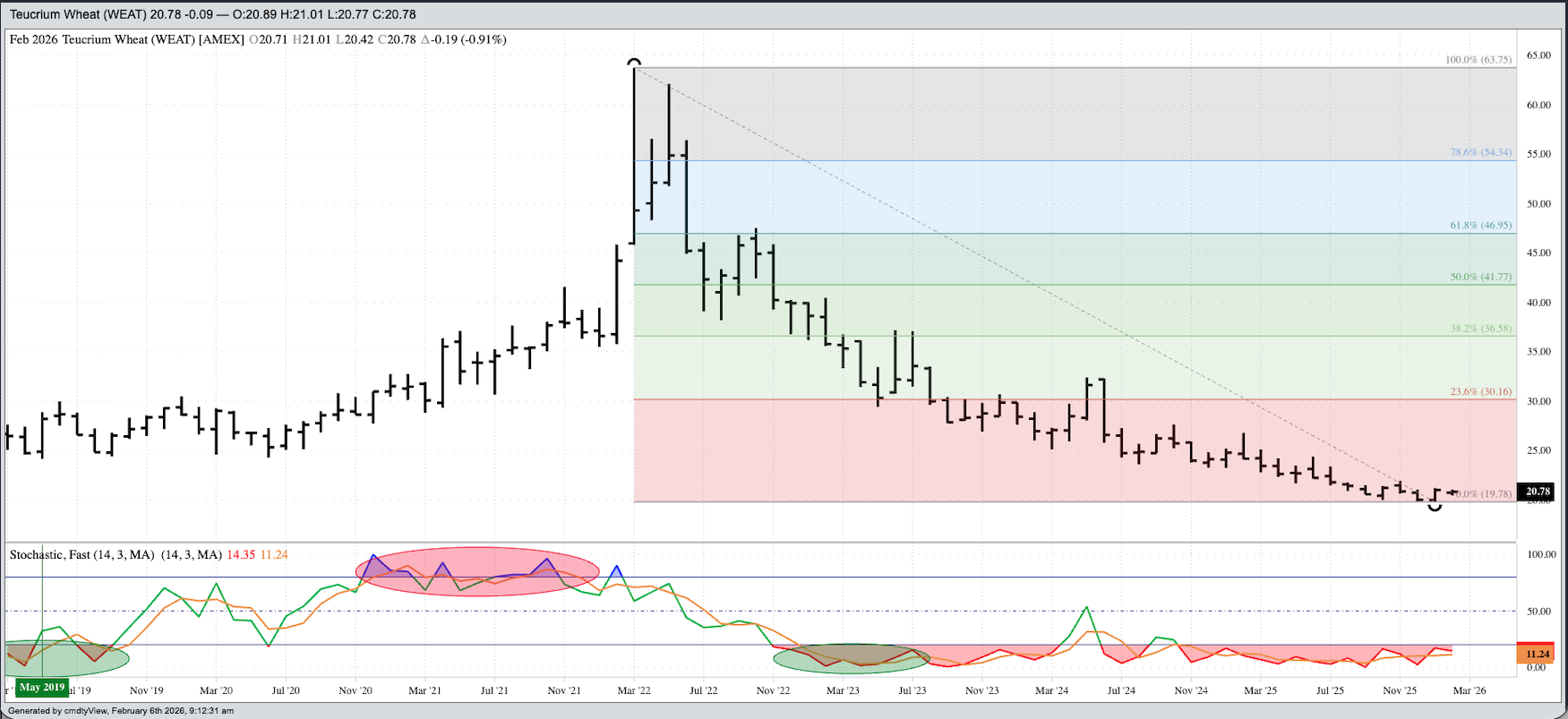

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.The wild card, fittingly enough is wheat were we see a divergence between fundamental and technical reads.

Since I got into this business back in the mid 1980s, I’ve viewed the commodity complex as an investment opportunity. In the early days, back when commodities were more like Dodge City than Wall Street, it was hard to see markets in the complex as anything other than short-term opportunities. One story from back then, sporting my Series 3 license like a greenhorn wearing a brand-new gun belt into a saloon, my financial advisor had to explain to me many times I shouldn’t be treating mutual funds like commodities.

In the mid 2000s, while in New York to speak at an Energies sector investment meeting (yes, believe it or not I used to be invited to talk about things other than corn and soybeans), I was invited to have coffee with CNBC’s lead stock market analyst at the time. He and I had been emailing back and forth about my view as commodities as investments and his concern over the commoditization of US stock indexes. It was an interesting conversation, albeit brief, as he had to catch the train back home and I had to find my way back to the hotel.

These days, I still analyze long-term monthly charts for 30-some commodity markets in my investment newsletter. It’s interesting how my perspective has changed over the decades. In my twenties, a long-term position in a commodity market was a couple days to maybe a week. Then when midlife rolled around my attention was largely on weekly charts, a change that spawned what I call the Goldilocks Principle (Daily charts are too hot, monthly charts are too cold, but weekly charts are just right). As the end of my career gets a bit larger on the horizon, I’m more content to not get caught up in the day-to-day, week-to-week nonsense and focus on major (long-term) trends.

As you’ll recall, the market I track most is corn, meaning most of my attention is still on the Grains sector. Why? Because of something I learned by reading legendary investor Peter Lynch back many decades ago, “Invest what you know”. To this I have added my Market Rule #6 (out of 7), “Fundamentals in in the end”. Since I have spent roughly 40 years studying grain fundamentals, and by that I mean real supply and demand as opposed to the imaginary kind released by USDA each month, I have a better feel for grains than energies, or softs, or even livestock. Therefore, when it comes to long-term investment positions in the Grains sector I consider both technical patterns and what I know about fundamentals, both short-term and long-term.

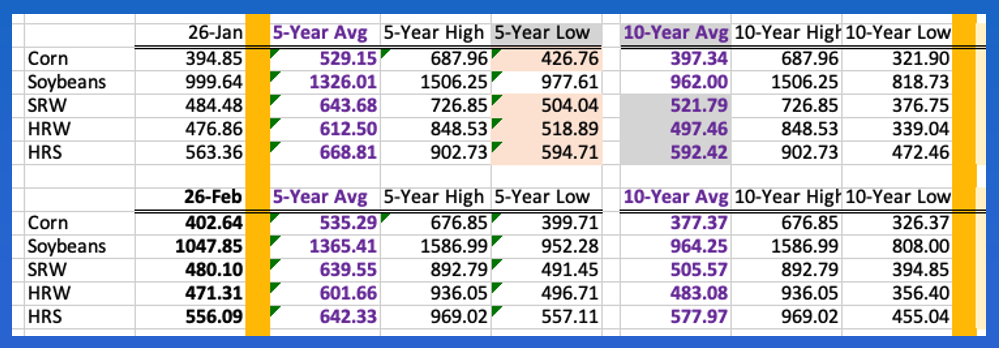

At the end of January, immediate-term fundamentals for corn ($CNCI) and the three wheat markets ($CSWI) ($CRWI) ($CRSI) were bearish. Those four National Cash Indexes were below previous 5-year end of the month lows. Meanwhile, the National Soybean Index ($CNSI) held above its previous January low of $9.7761 due to the lingering effects of market manipulation last fall. (In an interesting twist, we’ve seen the same sort of misinformation spark a rally in soybeans the first week of February. Rational human beings know what is being posted on “Truth” Social isn’t – well – true, but Watson still hasn’t evolved to account for the source of the misinformation. Maybe someday.)

Here then is my long-term analysis posted on February 1, with updated comments including what we’ve seen the first week of the month. Also, since futures markets aren’t for everyone, this piece will focus on what I wrote for the three Grains sector Teucrium Funds. Yes, I see how things have come full circle as I talk about Grains in a mutual fund sort of way. My old financial advisor, and maybe the since retired CNBC analyst would get a chuckle out of it.

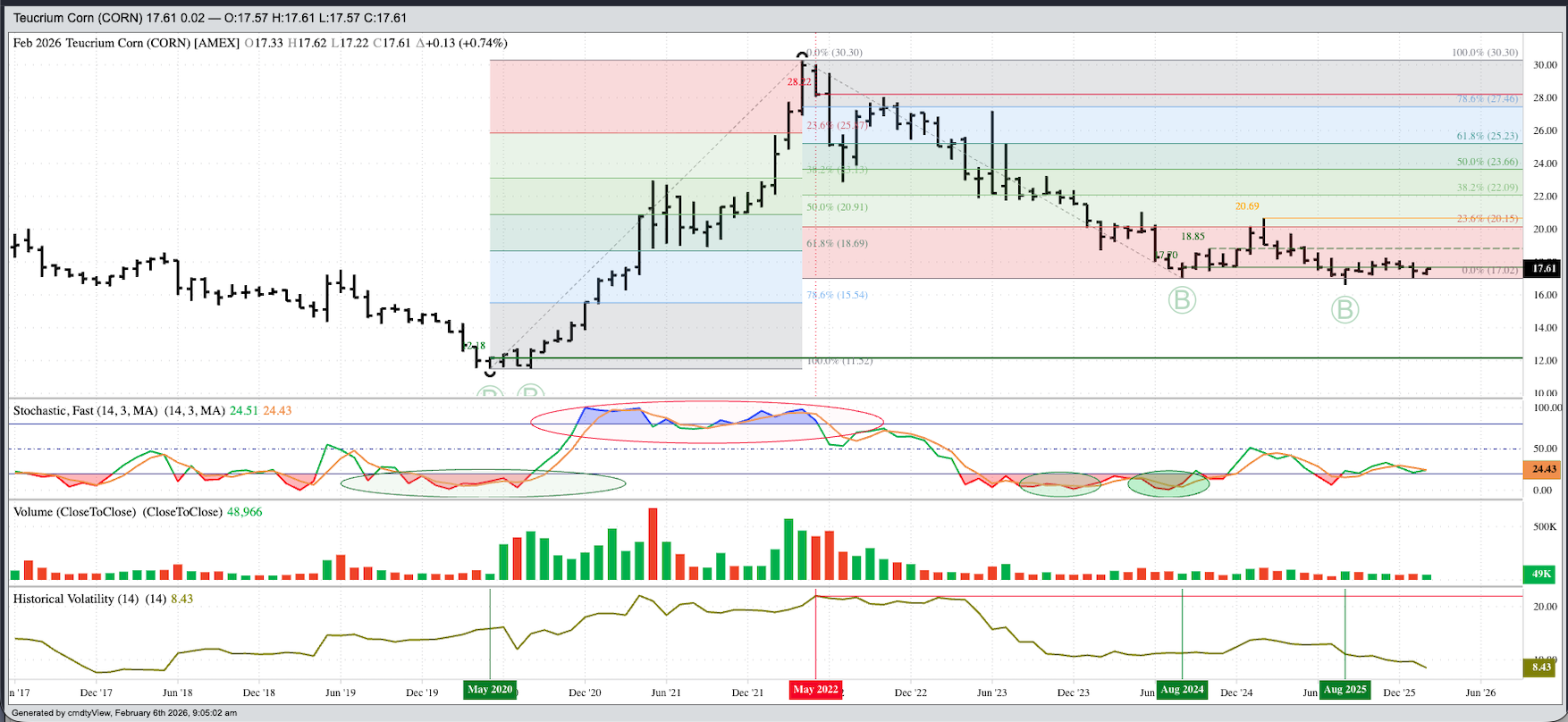

The Teucrium Corn Fund (CORN) remains in a major sideways trend. However, CORN did complete a bullish outside month during October, possibly sparking another round of buying interest. Theoretical Positions: CORN could’ve been bought near the August 2024 settlement of $17.70. Some may have added longs or established initial positions near the August 2025 settlement of $17.57 based on a bullish spike reversal. A new round of buys could’ve been made near the October settlement of $17.79. All these combined would put the average position near $17.75. CORN closed January at $17.48, down $0.25 for the month. So far in February CORN is up $0.13. Fundamentally, I still like the corn market longer-term based on the May-July futures spread covering a bullish 30% calculated full commercial carry and the idea 2026 could see corn planted area lose ground to soybeans at a time when demand is strong for corn and still weak for soybeans.

The Teucrium Soybean Fund (SOYB) confirmed a major uptrend at the end of December 2024 as it completed a bullish spike reversal. Since then, there have been numerous rallies and selloffs with the general technical picture still higher prices over time, the definition of an uptrend. Theoretical Positions: Investors might’ve bought near the December 2024 settlement of $21.48 with sell stops below the December low of $20.20. Some may have added long positions near the April 2025 settlement of $21.47. Additional longs could’ve been added near the October 2025 settlement, creating an average price of $22.13. SOYB closed January at $22.24, up $0.38 for the month. Due to the politically motivated manufactured rally the first week of February, SOYB has already gained $0.97 this month, drawing nearer to the previous peak of $23.86 from November 2025, also tied to social media misinformation.

The Teucrium Wheat Fund (WEAT) completed a bullish key reversal during January, once again telling us the major trend has turned up. We’ve seen this before, most recently at the end of October 2025. Theoretical Positions: If investors want to take another shot at going long the market, they might’ve done so near the January settlement of $20.97 with a sell stop below the January low of $19.78. Based on the Law of Supply and Demand, with all three National Wheat Indexes below previous 5-year end of month lows, it is hard to make a bullish fundamental case for WEAT as a long-term investment buy.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart