Packaged foods company B&G Foods (NYSE:BGS) fell short of the market’s revenue expectations in Q2 CY2025, with sales falling 4.5% year on year to $424.4 million. The company’s full-year revenue guidance of $1.86 billion at the midpoint came in 0.5% below analysts’ estimates. Its non-GAAP profit of $0.04 per share was $0.02 below analysts’ consensus estimates.

Is now the time to buy B&G Foods? Find out by accessing our full research report, it’s free.

B&G Foods (BGS) Q2 CY2025 Highlights:

- Revenue: $424.4 million vs analyst estimates of $429.6 million (4.5% year-on-year decline, 1.2% miss)

- Adjusted EPS: $0.04 vs analyst estimates of $0.06 ($0.02 miss)

- Adjusted EBITDA: $57.98 million vs analyst estimates of $60.63 million (13.7% margin, 4.4% miss)

- Adjusted EPS guidance for the full year is $0.55 at the midpoint, missing analyst estimates by 3.1%

- EBITDA guidance for the full year is $278 million at the midpoint, below analyst estimates of $280.2 million

- Operating Margin: 5.2%, down from 9.9% in the same quarter last year

- Market Capitalization: $330.4 million

Company Overview

Started as a small grocery store in New York City, B&G Foods (NYSE:BGS) is an American packaged foods company with a diverse portfolio of more than 50 brands.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.86 billion in revenue over the past 12 months, B&G Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

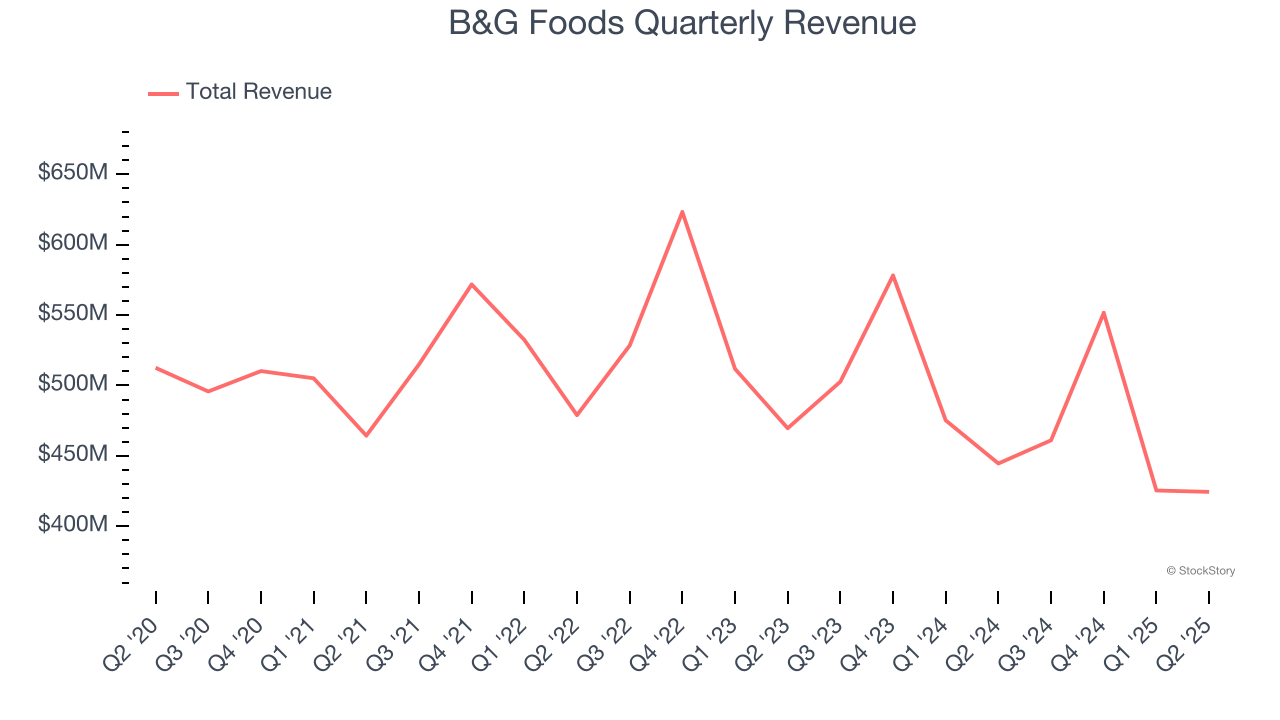

As you can see below, B&G Foods’s revenue declined by 3.9% per year over the last three years despite consumers buying more of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, B&G Foods missed Wall Street’s estimates and reported a rather uninspiring 4.5% year-on-year revenue decline, generating $424.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates its newer products will fuel better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

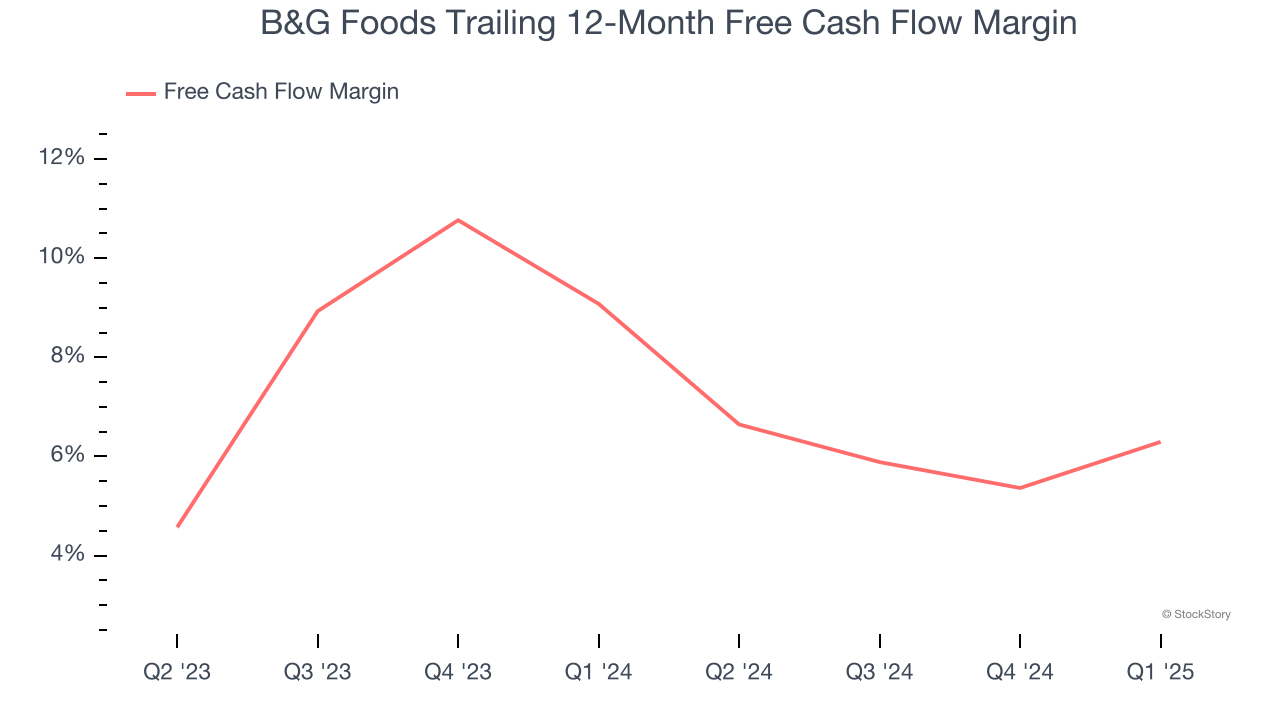

B&G Foods has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.2% over the last two years, better than the broader consumer staples sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Key Takeaways from B&G Foods’s Q2 Results

We struggled to find many positives in these results. Its EPS missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 1.5% to $4.07 immediately after reporting.

B&G Foods didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.