Digital media conglomerate IAC (NASDAQGS:IAC) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 7.5% year on year to $586.9 million. Its GAAP profit of $2.57 per share was significantly above analysts’ consensus estimates.

Is now the time to buy IAC? Find out by accessing our full research report, it’s free.

IAC (IAC) Q2 CY2025 Highlights:

- Revenue: $586.9 million vs analyst estimates of $601.5 million (7.5% year-on-year decline, 2.4% miss)

- EPS (GAAP): $2.57 vs analyst estimates of -$0.31 (significant beat)

- Adjusted EBITDA: $74.22 million vs analyst estimates of $43.89 million (12.6% margin, 69.1% beat)

- Full-year EBITDA outlook lowered due to incremental costs in the People Inc. (formerly Dotdash Meredith) segment

- Operating Margin: 0.1%, up from -3.4% in the same quarter last year

- Free Cash Flow was -$7.21 million, down from $79.96 million in the same quarter last year

- Market Capitalization: $3.1 billion

Company Overview

Originally known as InterActiveCorp and built through Barry Diller's strategic acquisitions since the 1990s, IAC (NASDAQ:IAC) operates a portfolio of category-leading digital businesses including Dotdash Meredith, Angi, and Care.com, focusing on digital publishing, home services, and caregiving platforms.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $2.52 billion in revenue over the past 12 months, IAC is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

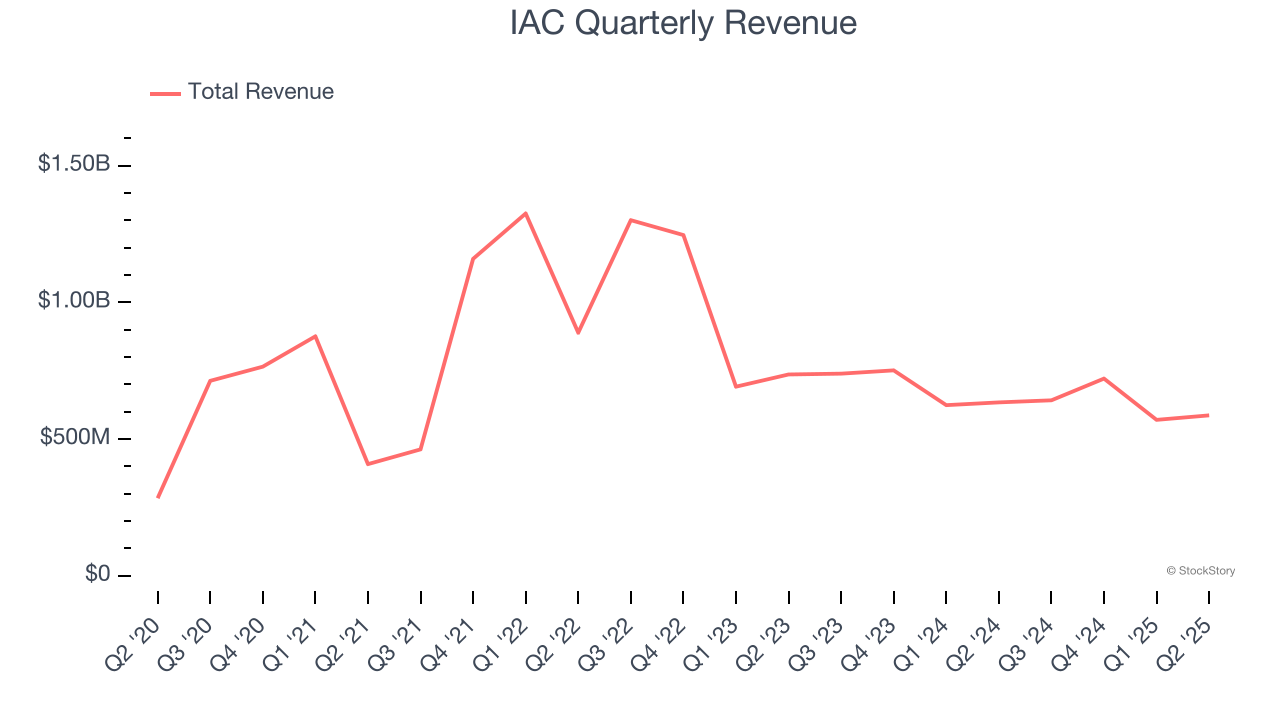

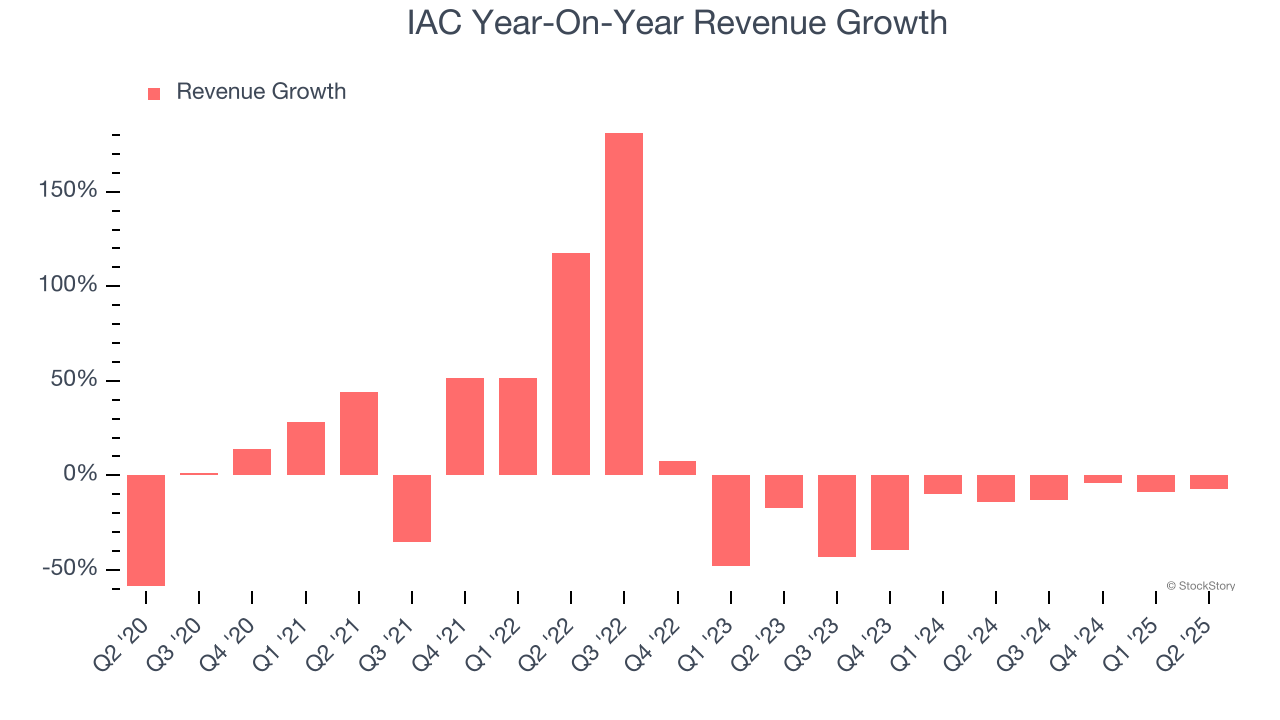

As you can see below, IAC’s 1.5% annualized revenue growth over the last five years was sluggish. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. IAC’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 20.4% annually.

This quarter, IAC missed Wall Street’s estimates and reported a rather uninspiring 7.5% year-on-year revenue decline, generating $586.9 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 1.3% over the next 12 months. While this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

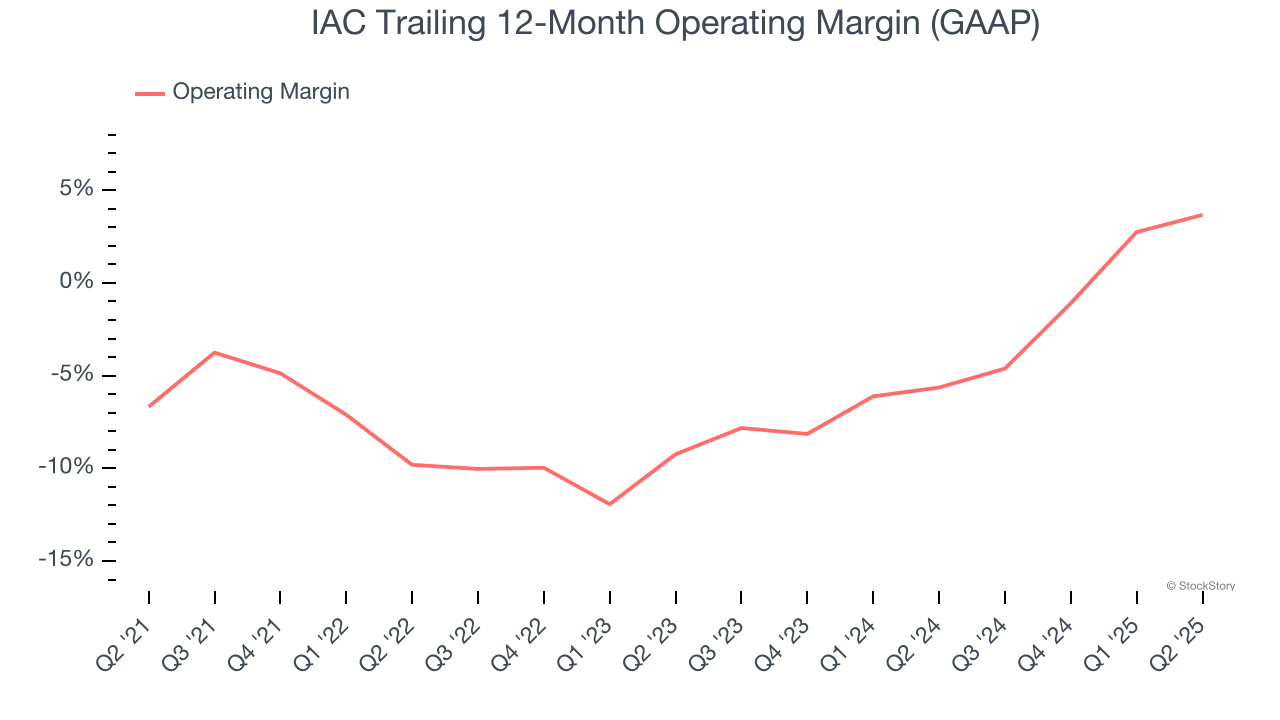

Operating Margin

Although IAC broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 6.3% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, IAC’s operating margin rose by 10.4 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, IAC’s breakeven margin was up 3.5 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

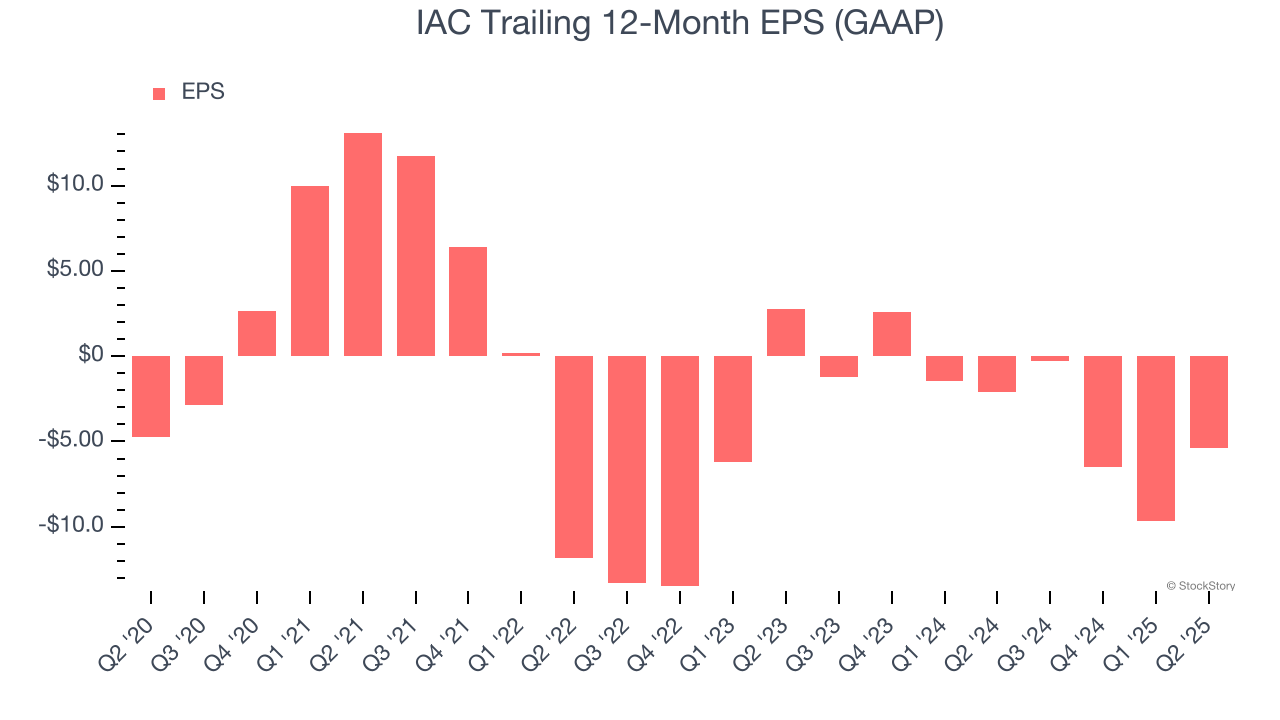

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

IAC’s earnings losses deepened over the last five years as its EPS dropped 2.7% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, IAC’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for IAC, its EPS declined by more than its revenue over the last two years, dropping 99.2%. This tells us the company struggled to adjust to shrinking demand.

In Q2, IAC reported EPS at $2.57, up from negative $1.71 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast IAC’s full-year EPS of negative $5.39 will reach break even.

Key Takeaways from IAC’s Q2 Results

We were impressed by how significantly IAC beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed and the company's full-year EBITDA guidance was lowered due to incremental costs in the People Inc. (formerly Dotdash Meredith) segment. Overall, this print was mixed. Investors were likely hoping for more, and shares traded down 3.9% to $37.95 immediately after reporting.

Is IAC an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.