Restaurant software company (NYSE:OLO) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 21.6% year on year to $85.72 million. Its non-GAAP profit of $0.07 per share was in line with analysts’ consensus estimates.

Is now the time to buy Olo? Find out by accessing our full research report, it’s free.

Olo (OLO) Q2 CY2025 Highlights:

- Revenue: $85.72 million vs analyst estimates of $82.26 million (21.6% year-on-year growth, 4.2% beat)

- Adjusted EPS: $0.07 vs analyst estimates of $0.08 (in line)

- Adjusted Operating Income: $13.09 million vs analyst estimates of $11.55 million (15.3% margin, 13.4% beat)

- Operating Margin: -3.2%, down from 1.4% in the same quarter last year

- Free Cash Flow was $24.03 million, up from -$1.90 million in the previous quarter

- Net Revenue Retention Rate: 114%, up from 111% in the previous quarter

- Billings: $84.93 million at quarter end, up 21.3% year on year

- Market Capitalization: $1.76 billion

“Olo continued to execute in the second quarter, generating revenue and non-GAAP operating income that exceeded the high-end of their respective guidance ranges,” said Noah Glass, Olo’s Founder and CEO.

Company Overview

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

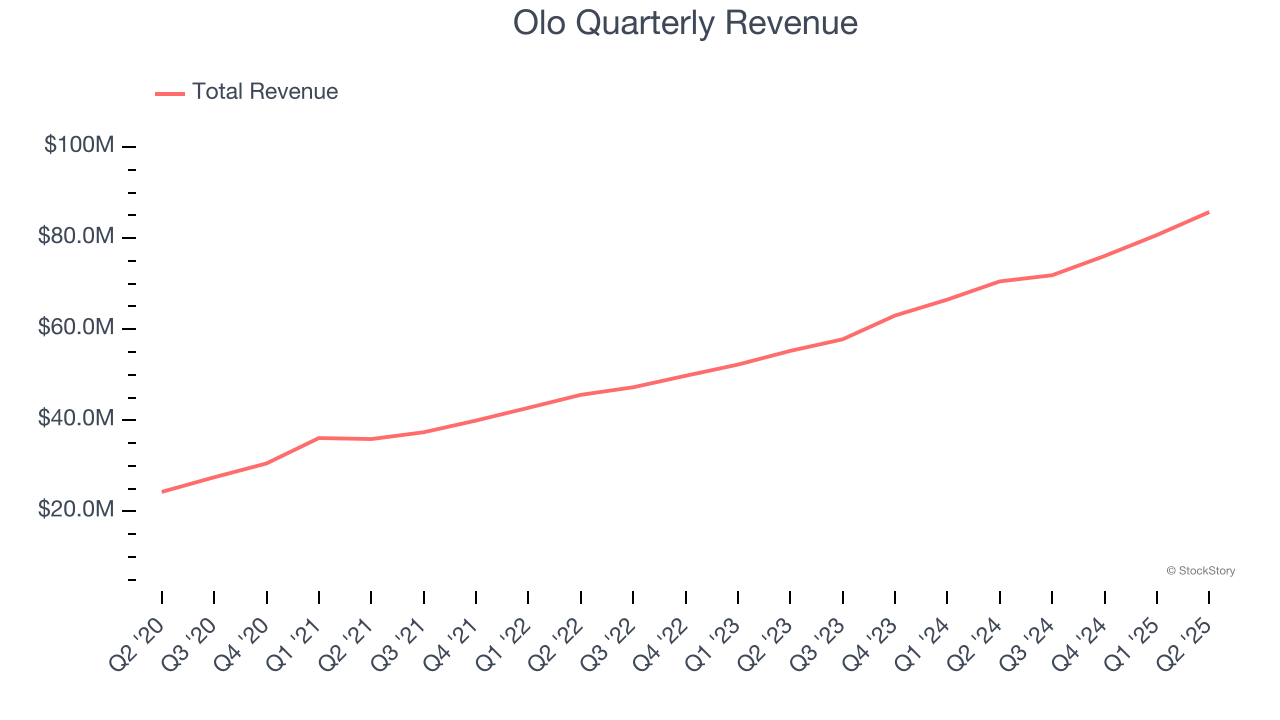

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Olo’s 23.8% annualized revenue growth over the last three years was decent. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, Olo reported robust year-on-year revenue growth of 21.6%, and its $85.72 million of revenue topped Wall Street estimates by 4.2%.

Looking ahead, sell-side analysts expect revenue to grow 17.4% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is noteworthy and suggests the market is forecasting success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

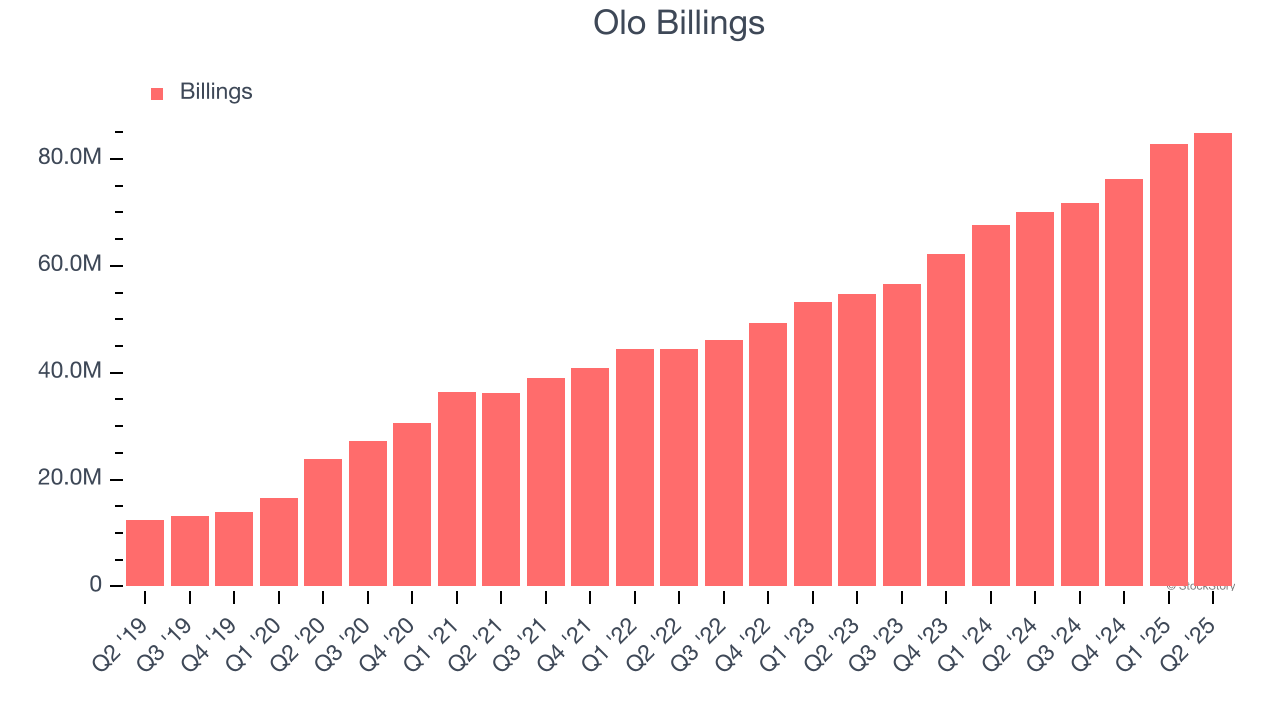

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Olo’s billings punched in at $84.93 million in Q2, and over the last four quarters, its growth was impressive as it averaged 23.2% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

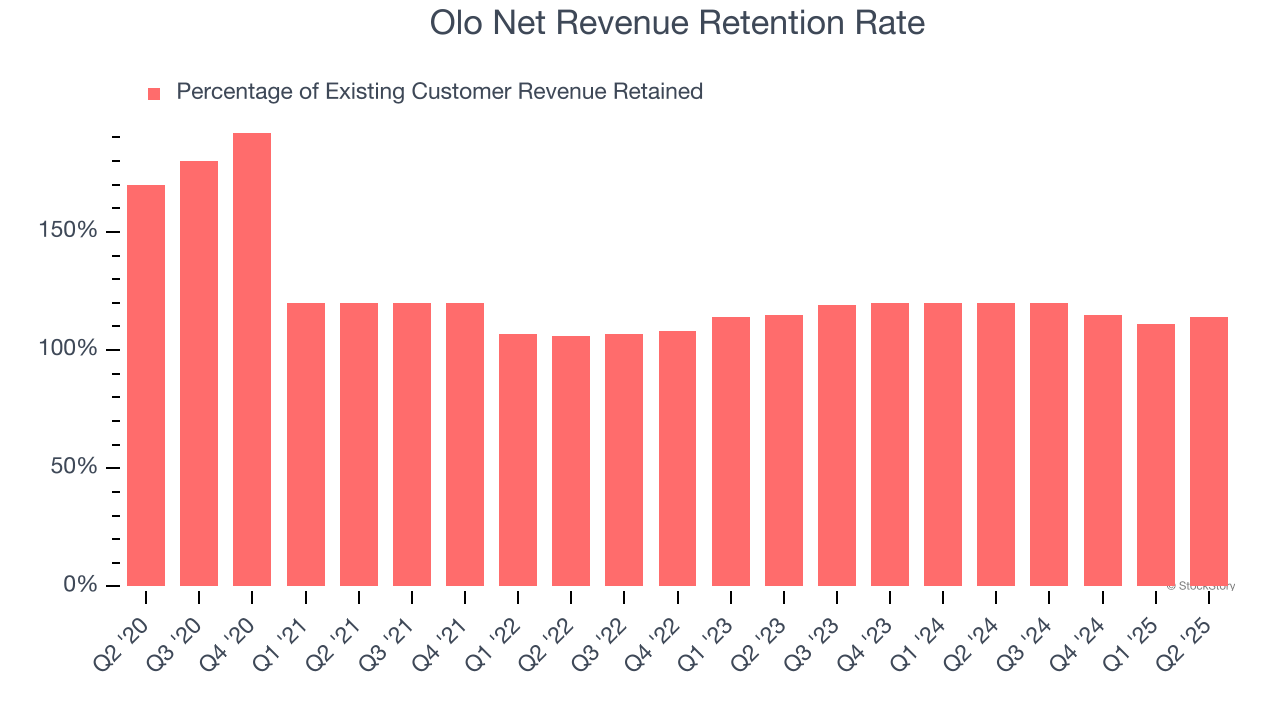

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Olo’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 115% in Q2. This means Olo would’ve grown its revenue by 15% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, Olo still has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from Olo’s Q2 Results

We enjoyed seeing Olo beat analysts’ billings expectations this quarter. We were also glad its net revenue retention grew. Zooming out, we think this quarter featured some important positives. The stock remained flat at $10.35 immediately following the results.

So should you invest in Olo right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.