Global pharmaceutical company Pfizer (NYSE:PFE) will be announcing earnings results this Tuesday before market open. Here’s what to look for.

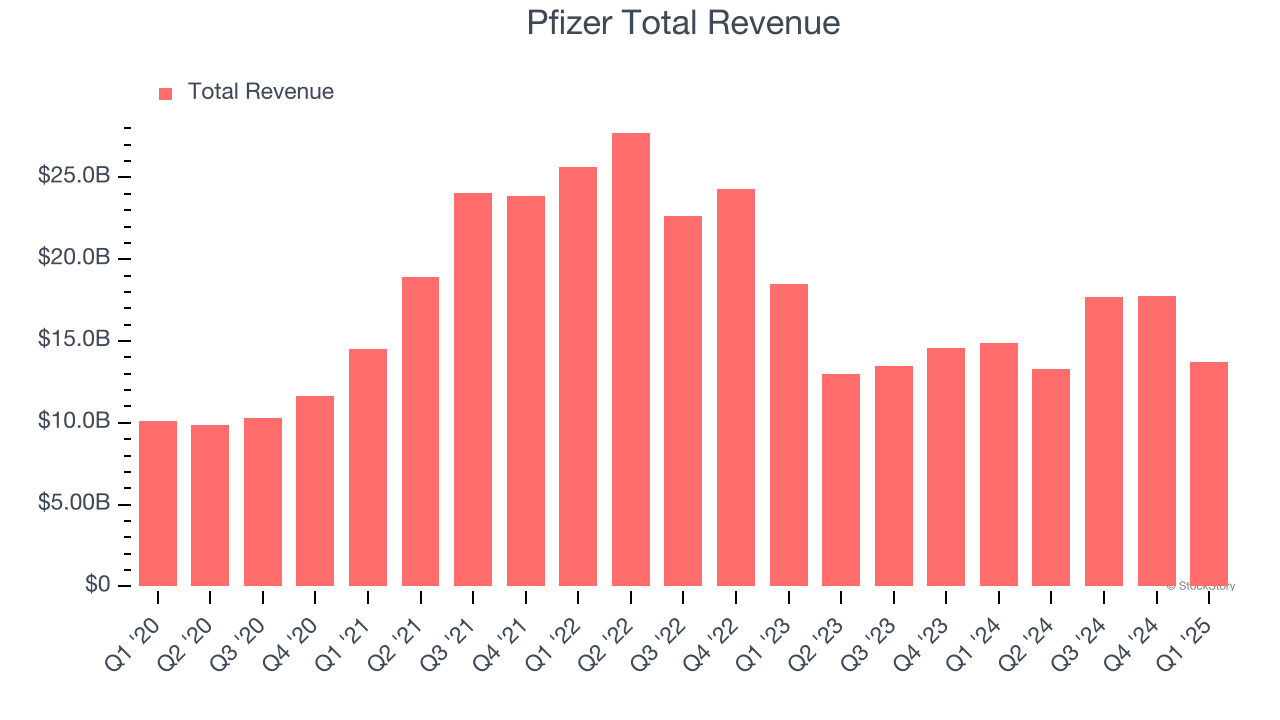

Pfizer missed analysts’ revenue expectations by 1.6% last quarter, reporting revenues of $13.72 billion, down 7.8% year on year. It was a mixed quarter for the company, with a solid beat of analysts’ organic revenue estimates but a miss of analysts’ full-year EPS guidance estimates.

Is Pfizer a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Pfizer’s revenue to grow 2.2% year on year to $13.58 billion, in line with the 2.1% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.57 per share.

Heading into earnings, analysts covering the company have grown increasingly bearish with revenue estimates seeing 6 downward revisions over the last 30 days (we track 11 analysts). Pfizer has missed Wall Street’s revenue estimates three times over the last two years.

Looking at Pfizer’s peers in the branded pharmaceuticals segment, some have already reported their Q2 results, giving us a hint as to what we can expect. Bristol-Myers Squibb posted flat year-on-year revenue, beating analysts’ expectations by 7.8%, and Merck reported a revenue decline of 1.9%, falling short of estimates by 1.1%. Bristol-Myers Squibb traded down 3.9% following the results while Merck was also down 2.7%.

Read our full analysis of Bristol-Myers Squibb’s results here and Merck’s results here.

Debates around the economy’s health and the impact of potential tariffs and corporate tax cuts have caused much uncertainty in 2025. While some of the branded pharmaceuticals stocks have shown solid performance in this choppy environment, the group has generally underperformed, with share prices down 4.3% on average over the last month. Pfizer is down 6.8% during the same time and is heading into earnings with an average analyst price target of $28.67 (compared to the current share price of $23.53).

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefiting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.