Scientific instruments company Waters Corporation (NYSE:WAT) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 8.9% year on year to $771.3 million. Guidance for next quarter’s revenue was better than expected at $781 million at the midpoint, 0.7% above analysts’ estimates. Its non-GAAP profit of $2.95 per share was in line with analysts’ consensus estimates.

Is now the time to buy Waters Corporation? Find out by accessing our full research report, it’s free.

Waters Corporation (WAT) Q2 CY2025 Highlights:

- Revenue: $771.3 million vs analyst estimates of $746.6 million (8.9% year-on-year growth, 3.3% beat)

- Adjusted EPS: $2.95 vs analyst expectations of $2.94 (in line)

- Adjusted EBITDA: $253 million vs analyst estimates of $261 million (32.8% margin, 3.1% miss)

- Revenue Guidance for Q3 CY2025 is $781 million at the midpoint, roughly in line with what analysts were expecting

- Management slightly raised its full-year Adjusted EPS guidance to $13 at the midpoint

- Operating Margin: 24.4%, down from 26.7% in the same quarter last year

- Free Cash Flow Margin: 2.4%, similar to the same quarter last year

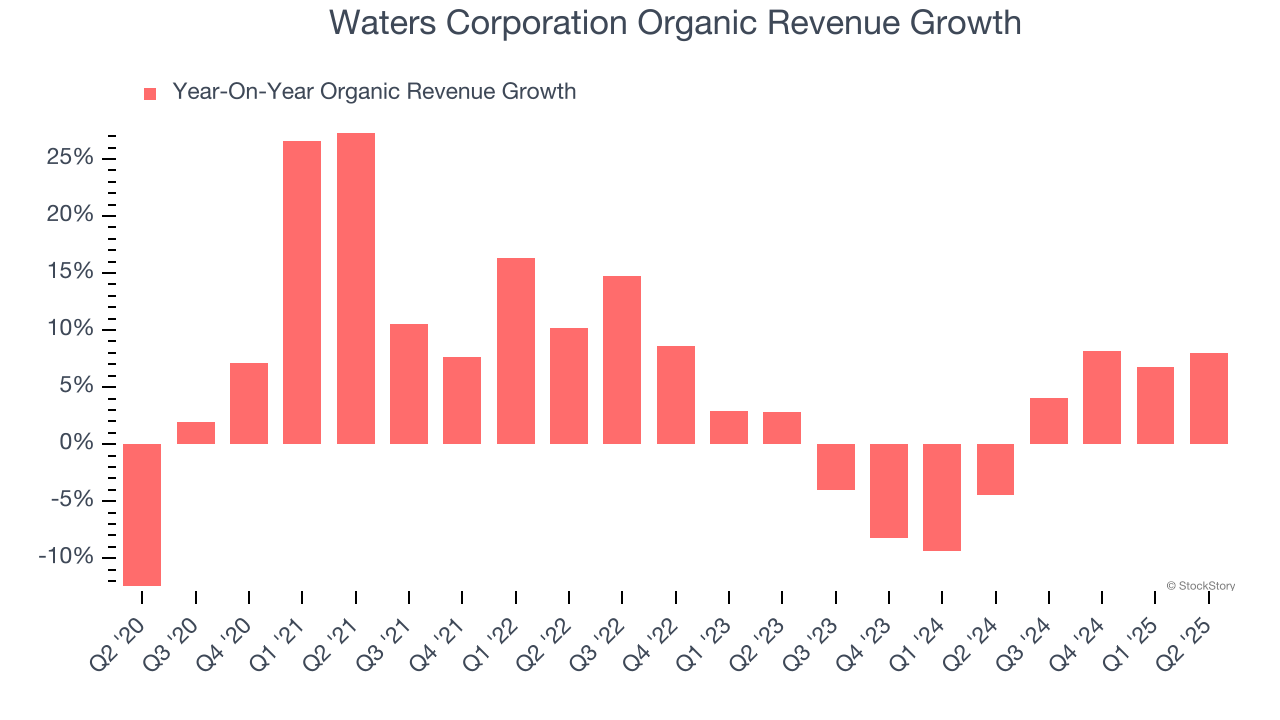

- Organic Revenue rose 8% year on year (-4.4% in the same quarter last year)

- Market Capitalization: $17.28 billion

"Our team continues to execute extremely well and we delivered excellent results again this quarter, driven by robust instrument replacement trends–particularly among large pharma and CDMO customers," said Dr. Udit Batra, President & CEO, Waters Corporation.

Company Overview

Founded in 1958 and pioneering innovations in laboratory analysis for over six decades, Waters (NYSE:WAT) develops and manufactures analytical instruments, software, and consumables for liquid chromatography, mass spectrometry, and thermal analysis used in scientific research and quality testing.

Revenue Growth

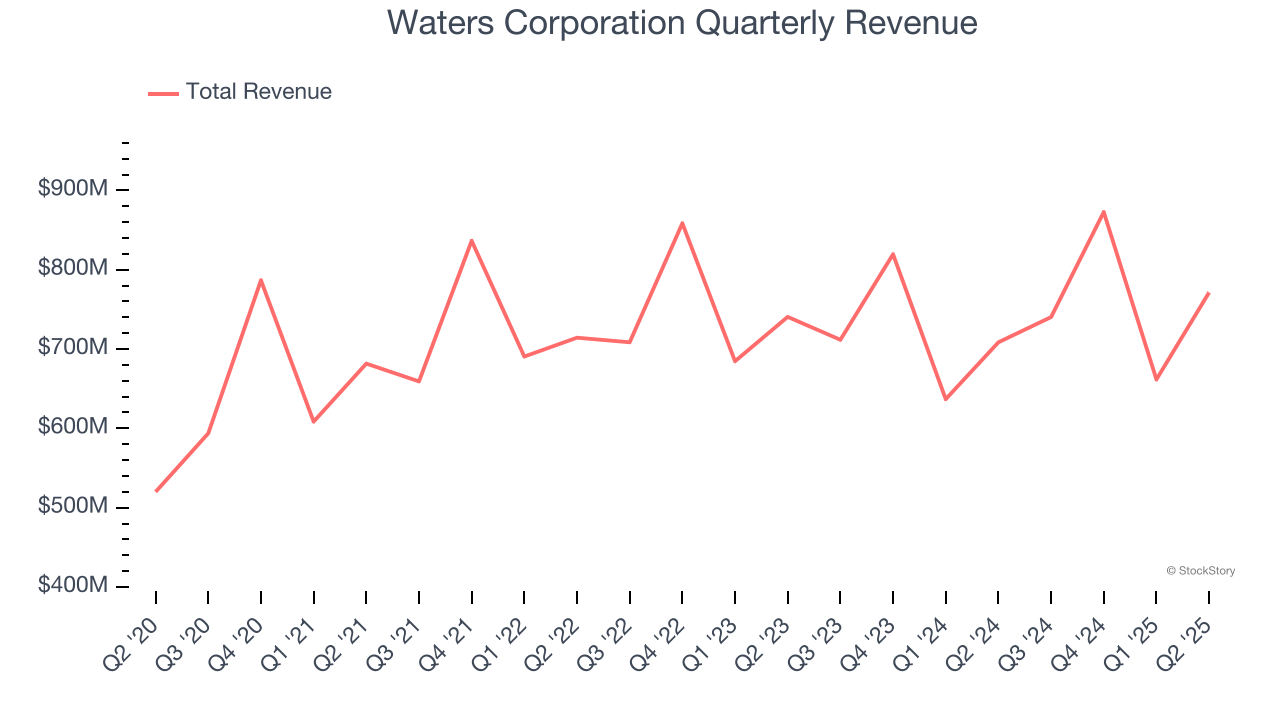

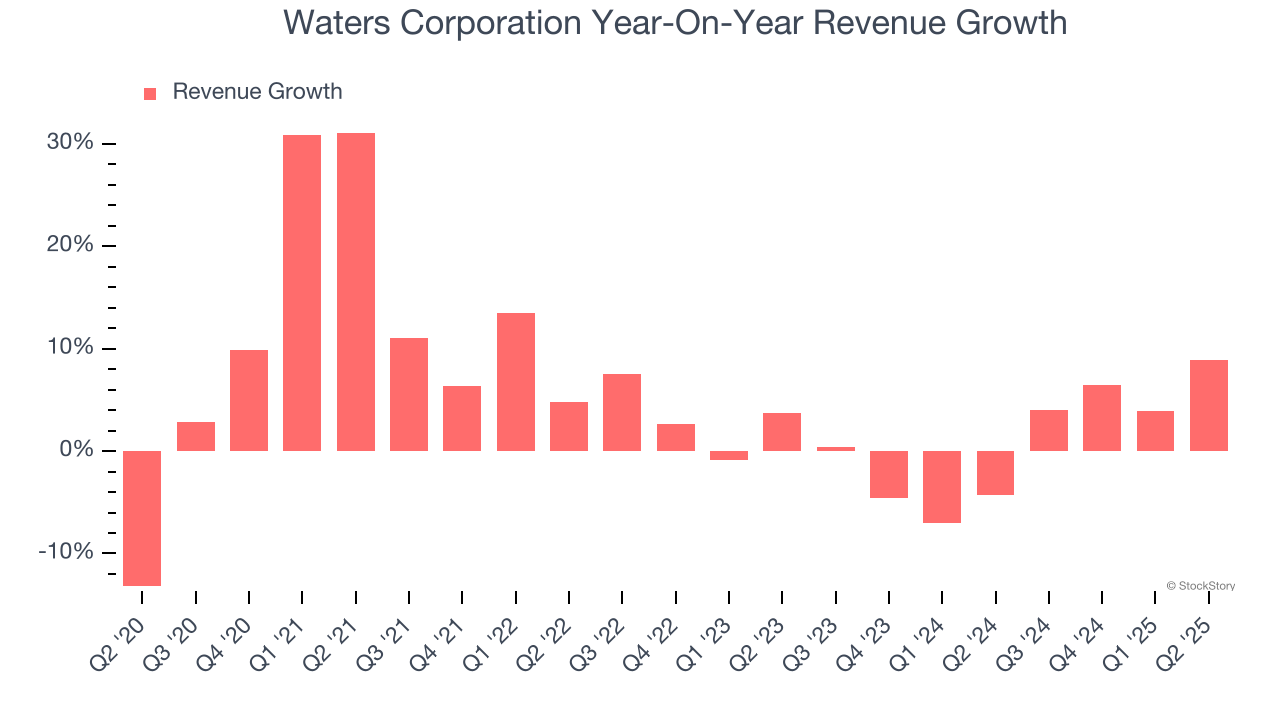

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Waters Corporation’s sales grew at a mediocre 6% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Waters Corporation’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

Waters Corporation also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Waters Corporation’s organic revenue was flat. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Waters Corporation reported year-on-year revenue growth of 8.9%, and its $771.3 million of revenue exceeded Wall Street’s estimates by 3.3%. Company management is currently guiding for a 5.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and indicates its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

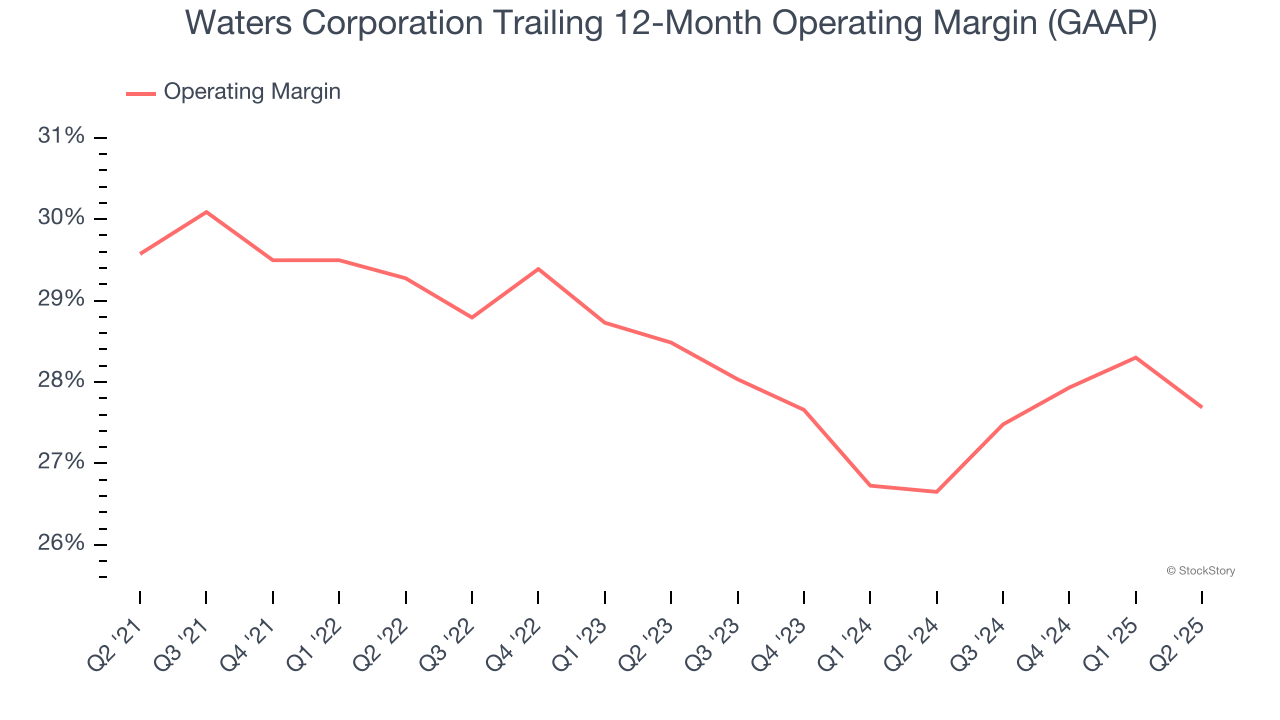

Waters Corporation has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 28.3%.

Looking at the trend in its profitability, Waters Corporation’s operating margin decreased by 1.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q2, Waters Corporation generated an operating margin profit margin of 24.4%, down 2.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

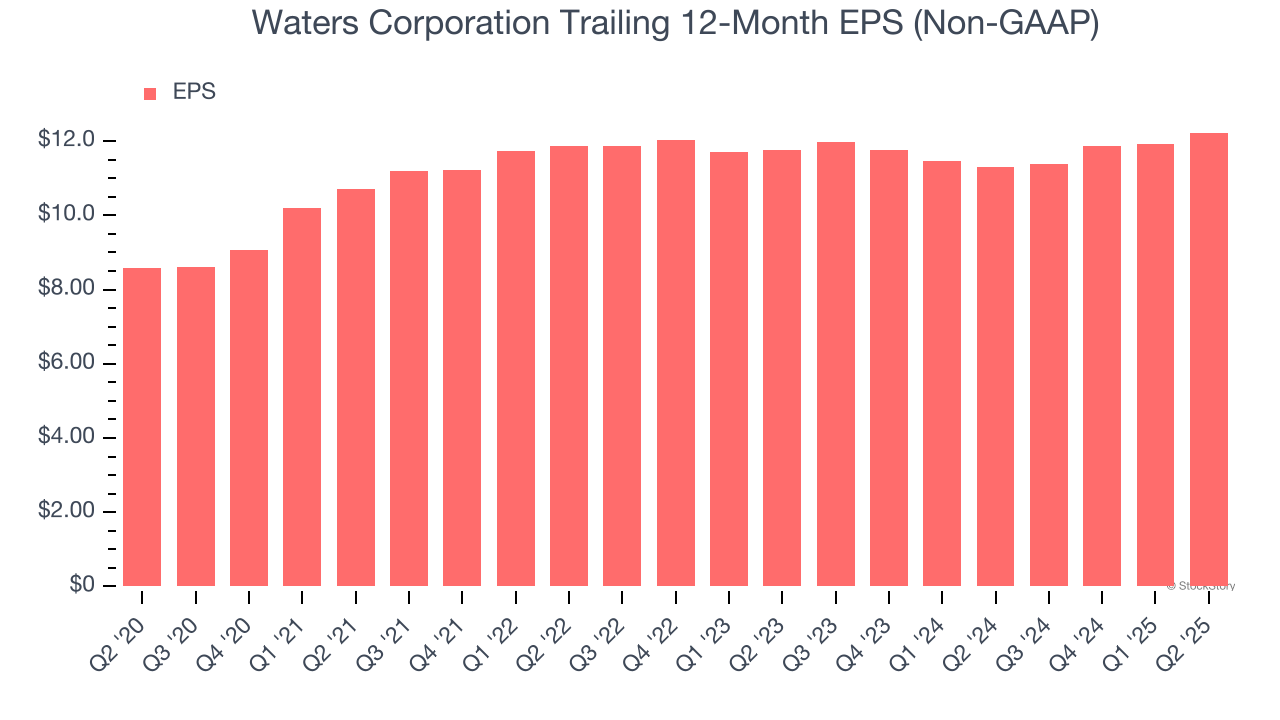

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Waters Corporation’s solid 7.3% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q2, Waters Corporation reported adjusted EPS at $2.95, up from $2.63 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Waters Corporation’s full-year EPS of $12.23 to grow 11%.

Key Takeaways from Waters Corporation’s Q2 Results

We enjoyed seeing Waters Corporation beat analysts’ revenue expectations this quarter. We were also glad its organic revenue outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter slightly missed. Overall, this print was mixed. The stock remained flat at $290.47 immediately after reporting.

Big picture, is Waters Corporation a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.