Technology real estate company Opendoor (NASDAQ:OPEN) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 3.7% year on year to $1.57 billion. On the other hand, next quarter’s revenue guidance of $837.5 million was less impressive, coming in 29.5% below analysts’ estimates. Its GAAP loss of $0.04 per share was in line with analysts’ consensus estimates.

Is now the time to buy Opendoor? Find out by accessing our full research report, it’s free.

Opendoor (OPEN) Q2 CY2025 Highlights:

- Revenue: $1.57 billion vs analyst estimates of $1.50 billion (3.7% year-on-year growth, 4.2% beat)

- EPS (GAAP): -$0.04 vs analyst estimates of -$0.03 (in line)

- Adjusted EBITDA: $23 million vs analyst estimates of $17.56 million (1.5% margin, 31% beat)

- Revenue Guidance for Q3 CY2025 is $837.5 million at the midpoint, below analyst estimates of $1.19 billion

- EBITDA guidance for Q3 CY2025 is -$24.5 million at the midpoint, below analyst estimates of -$4.86 million

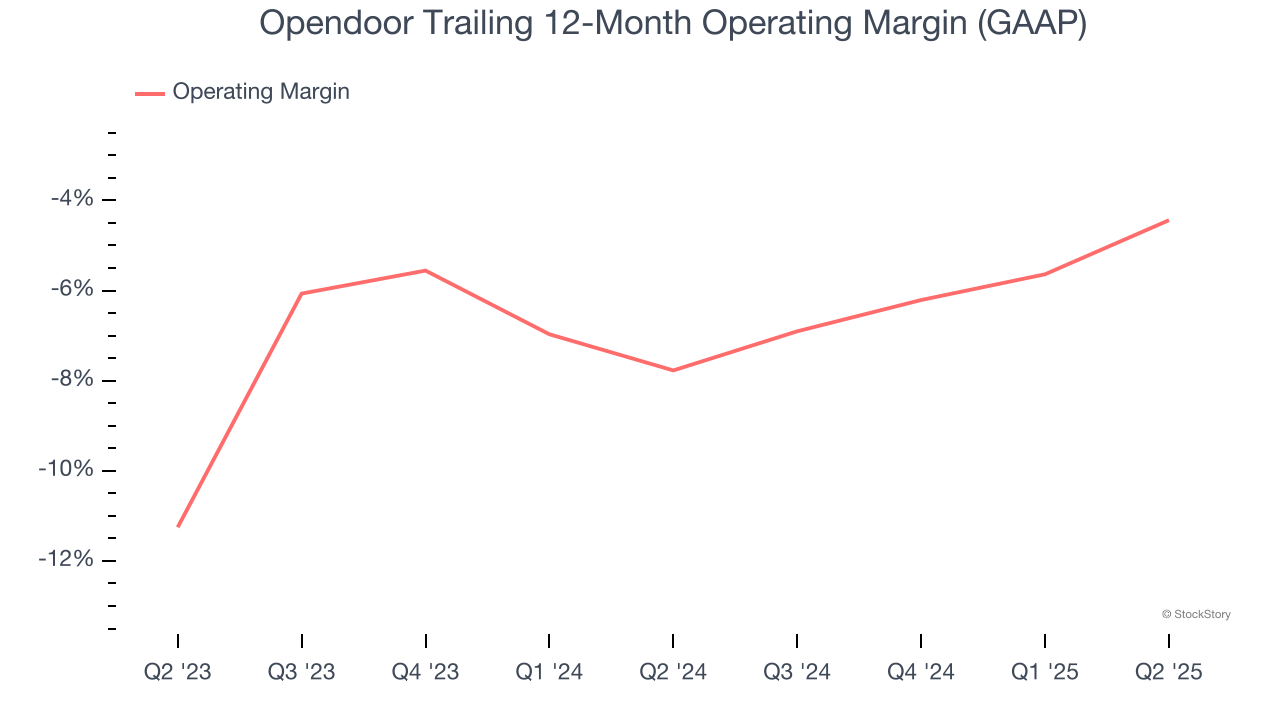

- Operating Margin: -0.8%, up from -4.8% in the same quarter last year

- Free Cash Flow was $821 million, up from -$407 million in the same quarter last year

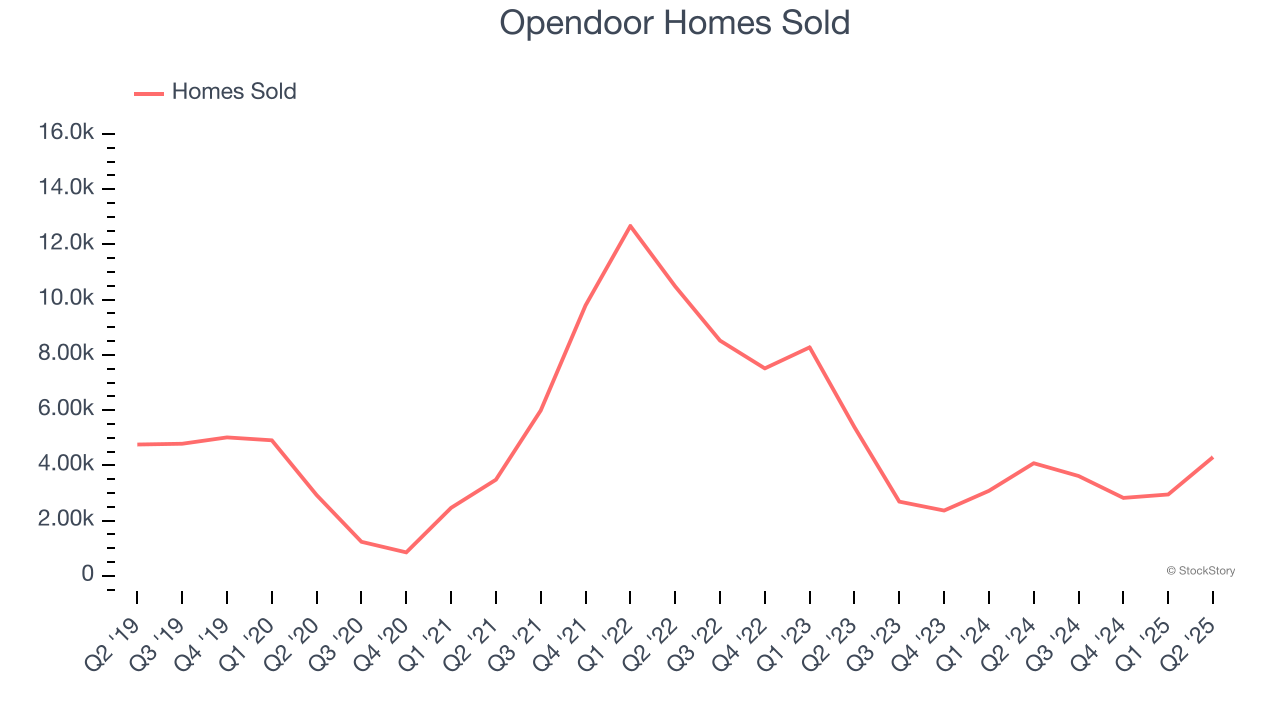

- Homes Sold: 4,299, up 221 year on year

- Market Capitalization: $1.79 billion

“We delivered $1.6 billion in revenue in the second quarter and achieved our first quarter of Adjusted EBITDA profitability since 2022, even as housing market conditions continued to deteriorate. This progress reflects the discipline and expertise we’ve built into every part of our business,” said Carrie Wheeler, CEO and Chair of the Board of Directors of Opendoor.

Company Overview

Founded by real estate guru Eric Wu, Opendoor (NASDAQ:OPEN) offers a technology-driven, convenient, and streamlined process to buy and sell homes.

Revenue Growth

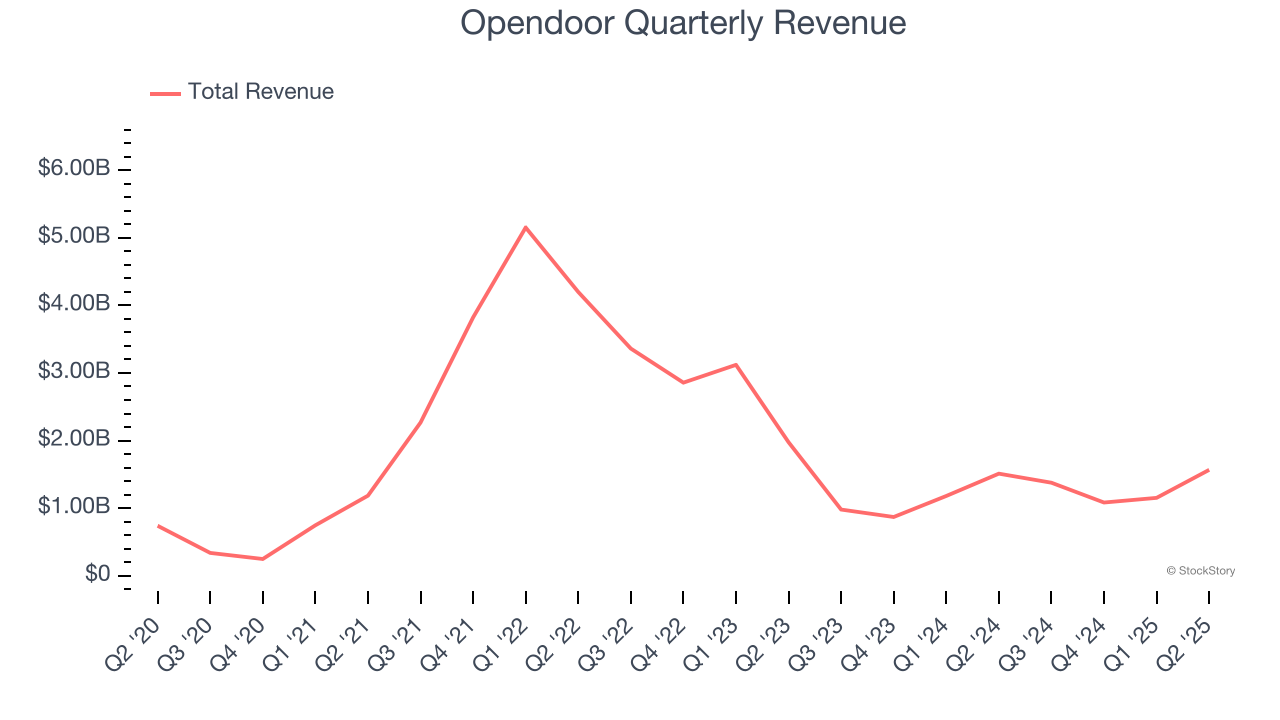

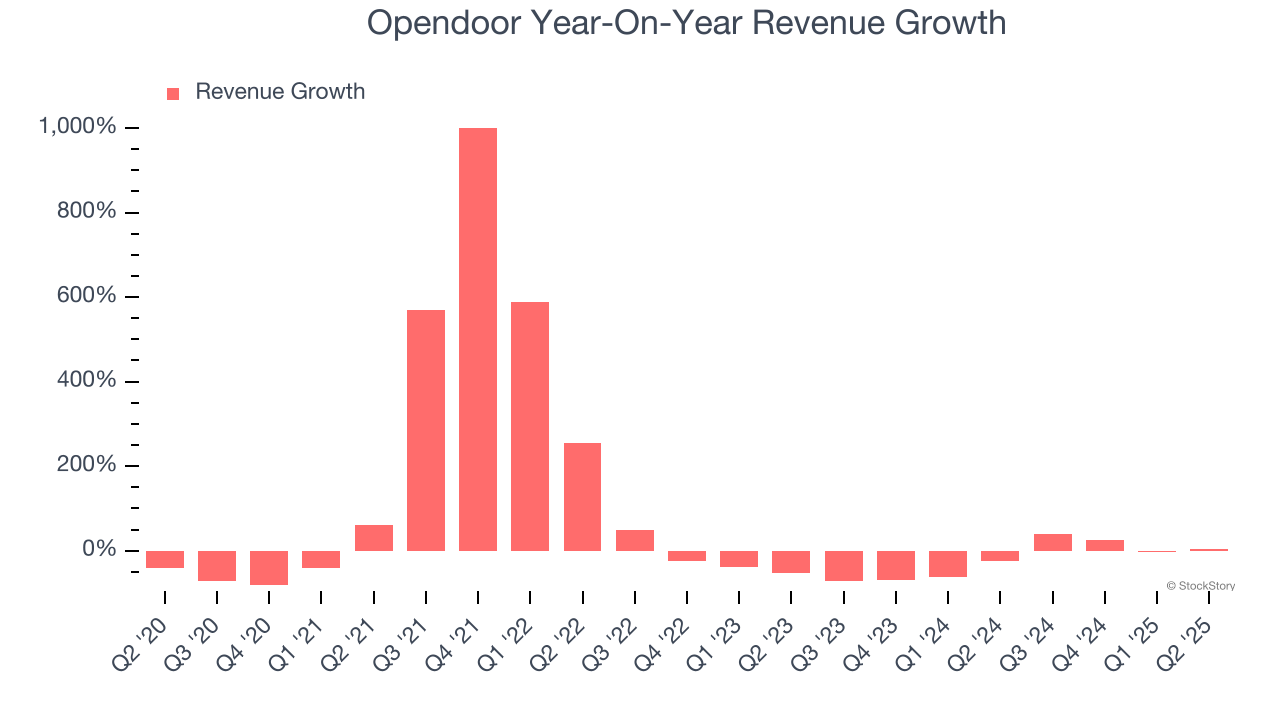

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Opendoor grew its sales at a sluggish 3% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Opendoor’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 32.3% annually.

We can dig further into the company’s revenue dynamics by analyzing its number of homes sold, which reached 4,299 in the latest quarter. Over the last two years, Opendoor’s homes sold averaged 21.1% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Opendoor reported modest year-on-year revenue growth of 3.7% but beat Wall Street’s estimates by 4.2%. Company management is currently guiding for a 39.2% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 3.9% over the next 12 months. Although this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Opendoor’s operating margin has risen over the last 12 months, but it still averaged negative 6% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, Opendoor generated a negative 0.8% operating margin. The company's consistent lack of profits raise a flag.

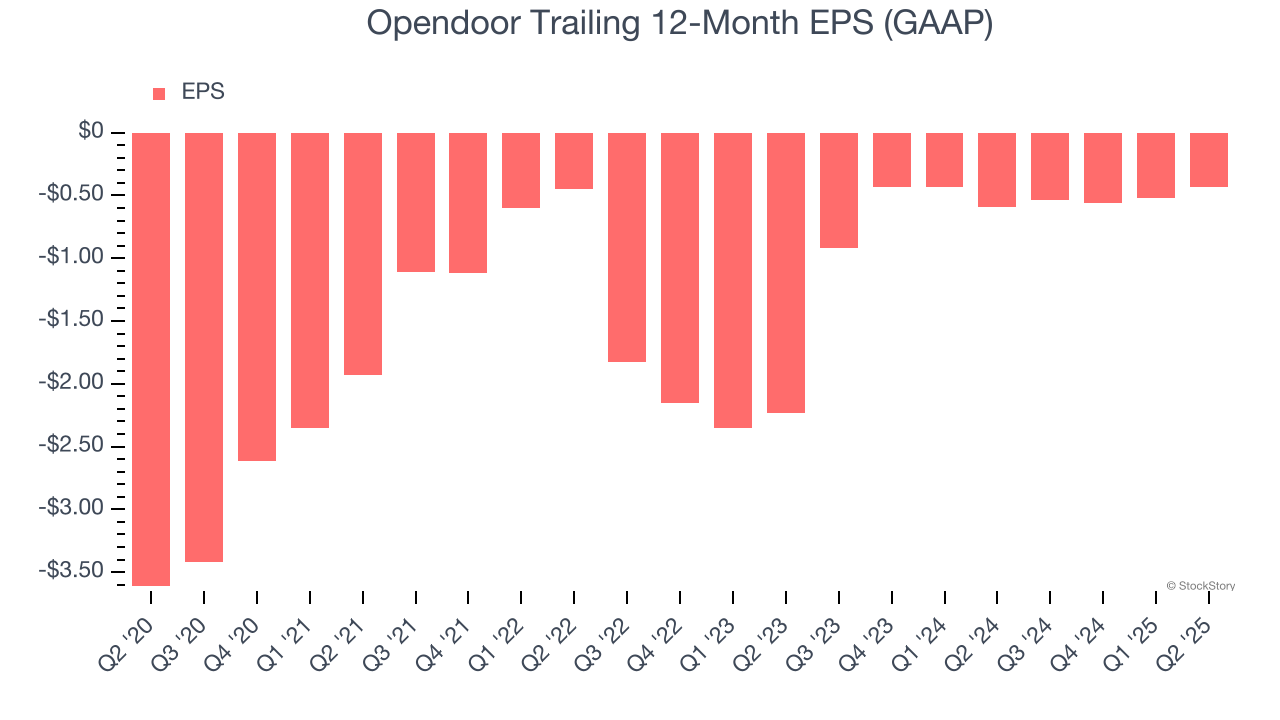

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Opendoor’s full-year earnings are still negative, it reduced its losses and improved its EPS by 34.7% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q2, Opendoor reported EPS at negative $0.04, up from negative $0.13 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Opendoor’s full-year EPS of negative $0.43 will reach break even.

Key Takeaways from Opendoor’s Q2 Results

Revenue and EBITDA in the quarter beat, but guidance was disappointing. Specifically, Q3 revenue guidance fell short of expectations and Q3 adjusted EBITDA guidance was even worse, missing by a large amount. Overall, this was a weaker quarter. The stock traded down 14.8% to $2.16 immediately following the results.

Opendoor didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.