Global pharmaceutical company Pfizer (NYSE:PFE) announced better-than-expected revenue in Q2 CY2025, with sales up 10.3% year on year to $14.65 billion. The company expects the full year’s revenue to be around $62.5 billion, close to analysts’ estimates. Its non-GAAP profit of $0.78 per share was 35.9% above analysts’ consensus estimates.

Is now the time to buy Pfizer? Find out by accessing our full research report, it’s free.

Pfizer (PFE) Q2 CY2025 Highlights:

- Revenue: $14.65 billion vs analyst estimates of $13.58 billion (10.3% year-on-year growth, 7.9% beat)

- Adjusted EPS: $0.78 vs analyst estimates of $0.57 (35.9% beat)

- The company reconfirmed its revenue guidance for the full year of $62.5 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $3 at the midpoint, a 3.4% increase

- Operating Margin: 20.8%, down from 22.4% in the same quarter last year

- Organic Revenue rose 10% year on year (3% in the same quarter last year)

- Market Capitalization: $133.8 billion

Company Overview

With roots dating back to 1849 when two German immigrants opened a fine chemicals business in Brooklyn, Pfizer (NYSE:PFE) is a global biopharmaceutical company that discovers, develops, manufactures, and sells medicines and vaccines for a wide range of diseases and conditions.

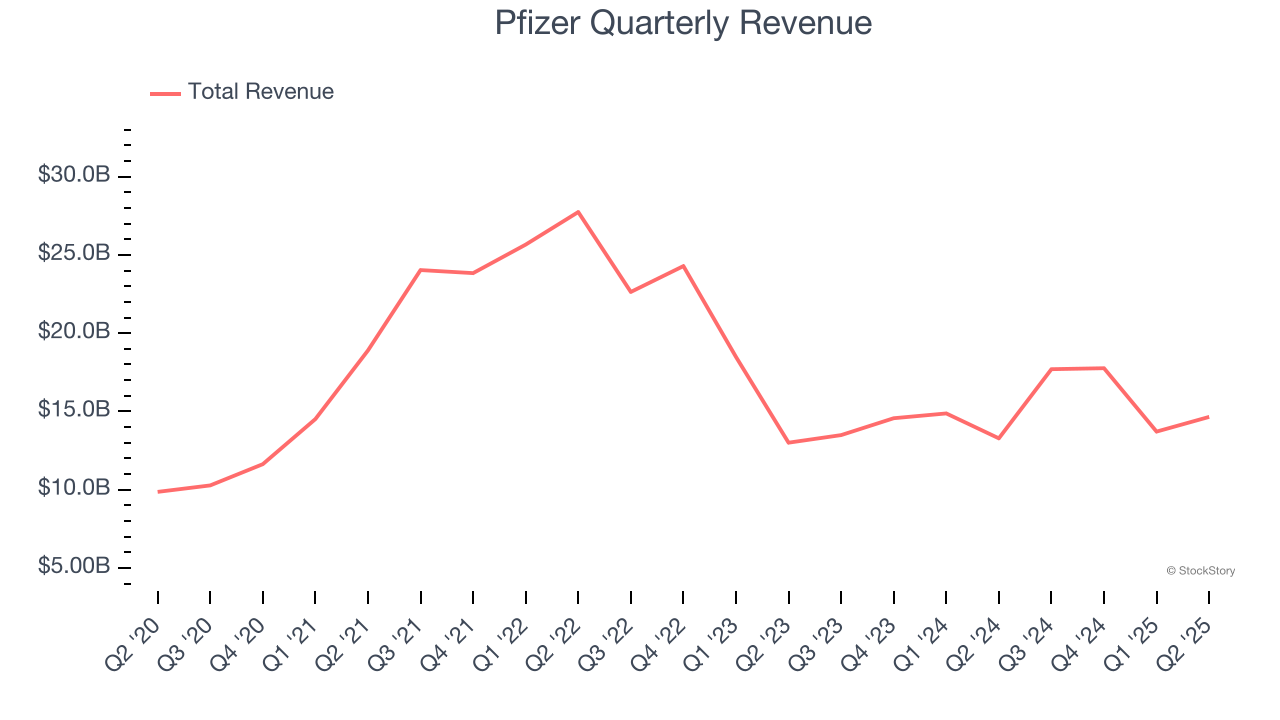

Revenue Growth

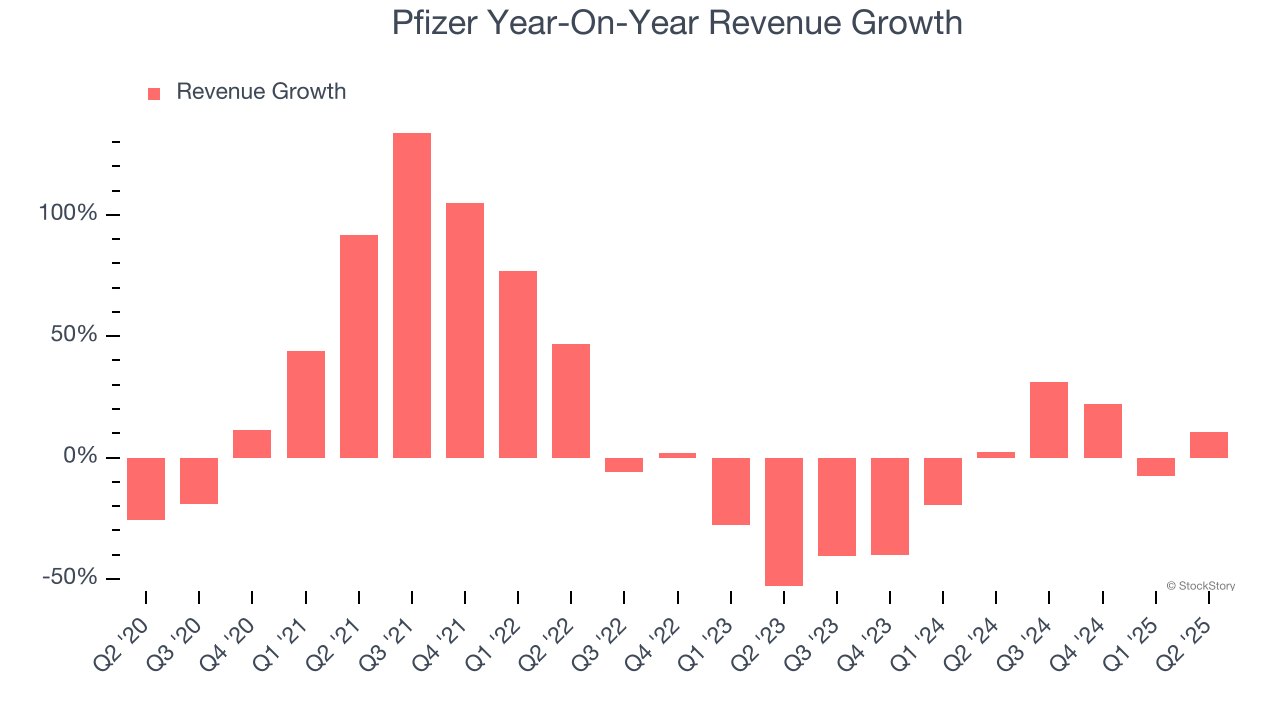

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Pfizer’s sales grew at a decent 8.2% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Pfizer’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 9.8% over the last two years.

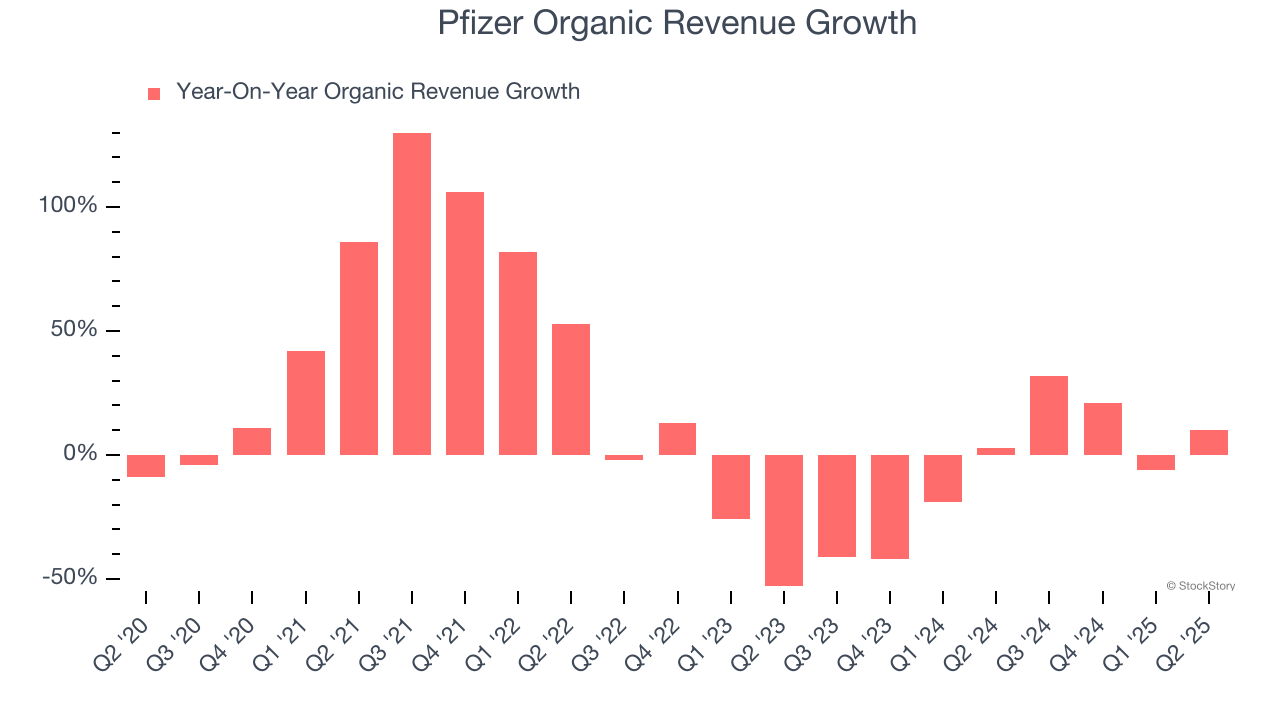

Pfizer also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Pfizer’s organic revenue averaged 5.2% year-on-year declines. Because this number is better than its two-year revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, Pfizer reported year-on-year revenue growth of 10.3%, and its $14.65 billion of revenue exceeded Wall Street’s estimates by 7.9%.

Looking ahead, sell-side analysts expect revenue to decline by 3.3% over the next 12 months. Although this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

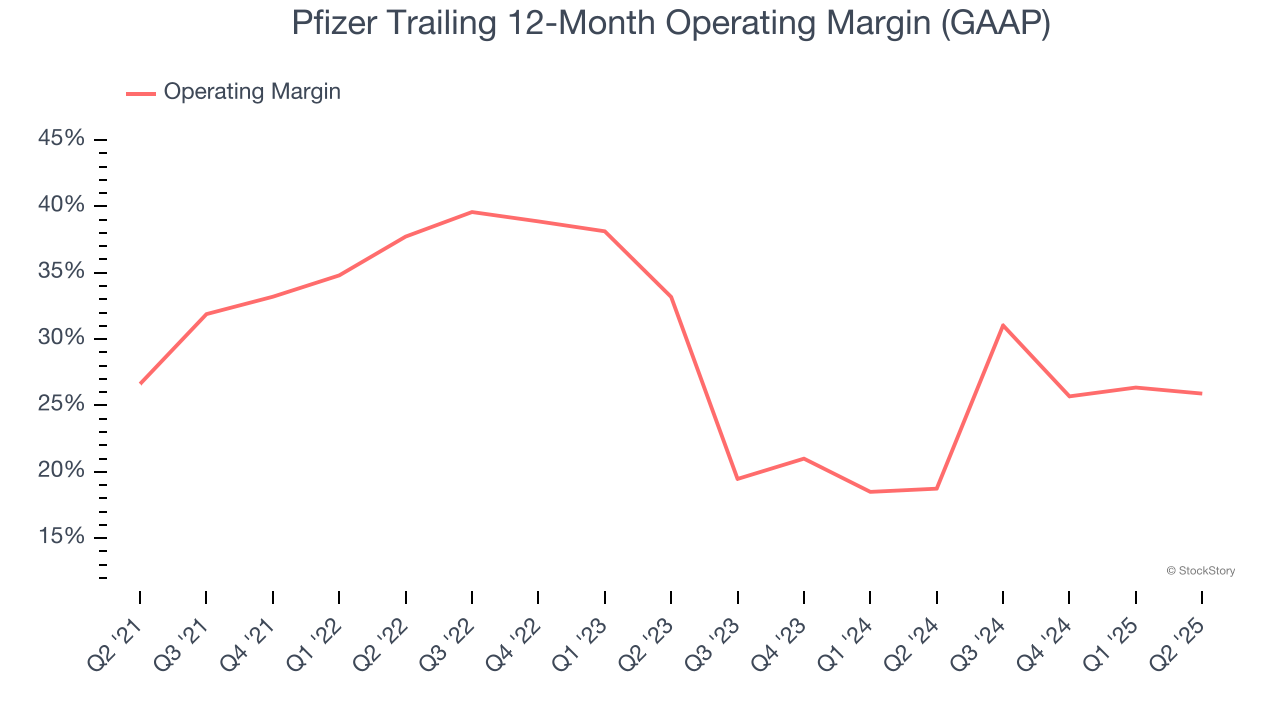

Pfizer’s operating margin has risen over the last 12 months and averaged 29.9% over the last five years. On top of that, its profitability was top-notch for a healthcare business, showing it’s an well-run company with an efficient cost structure.

Analyzing the trend in its profitability, Pfizer’s operating margin of 25.9% for the trailing 12 months may be around the same as five years ago, but it has decreased by 7.3 percentage points over the last two years. This dynamic unfolded because it failed to adjust its fixed costs while demand fell.

This quarter, Pfizer generated an operating margin profit margin of 20.8%, down 1.6 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

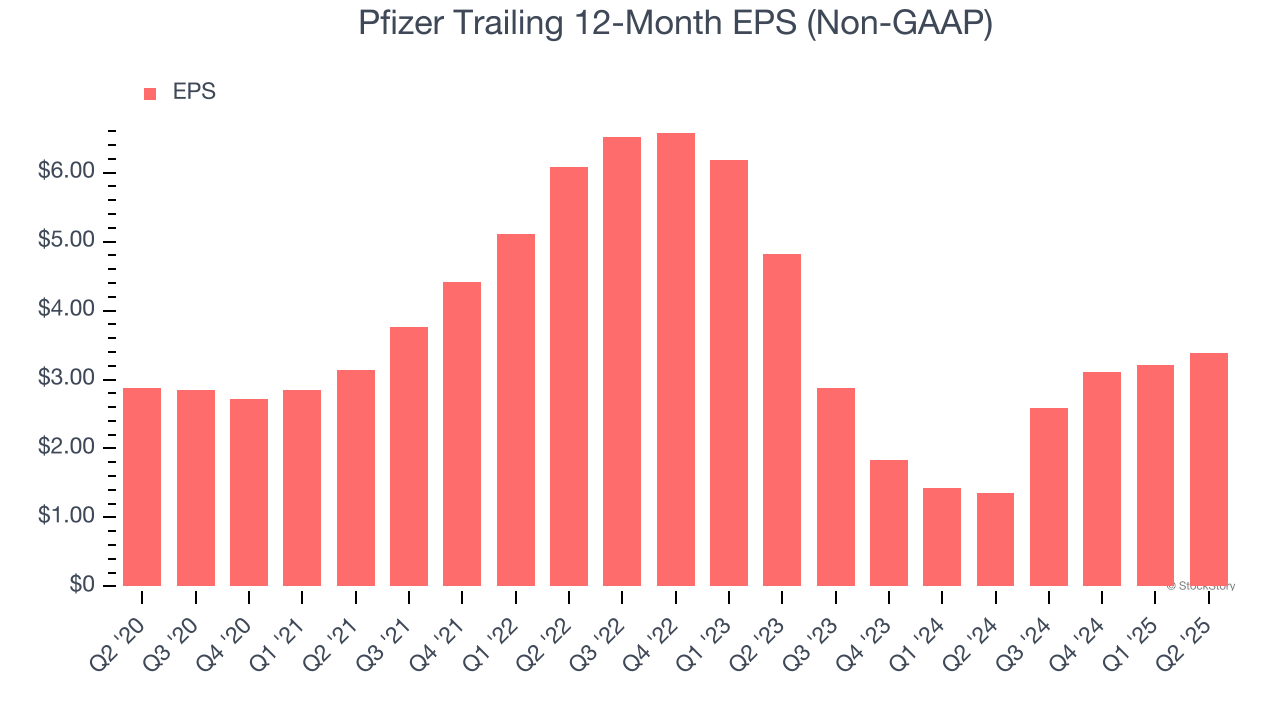

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

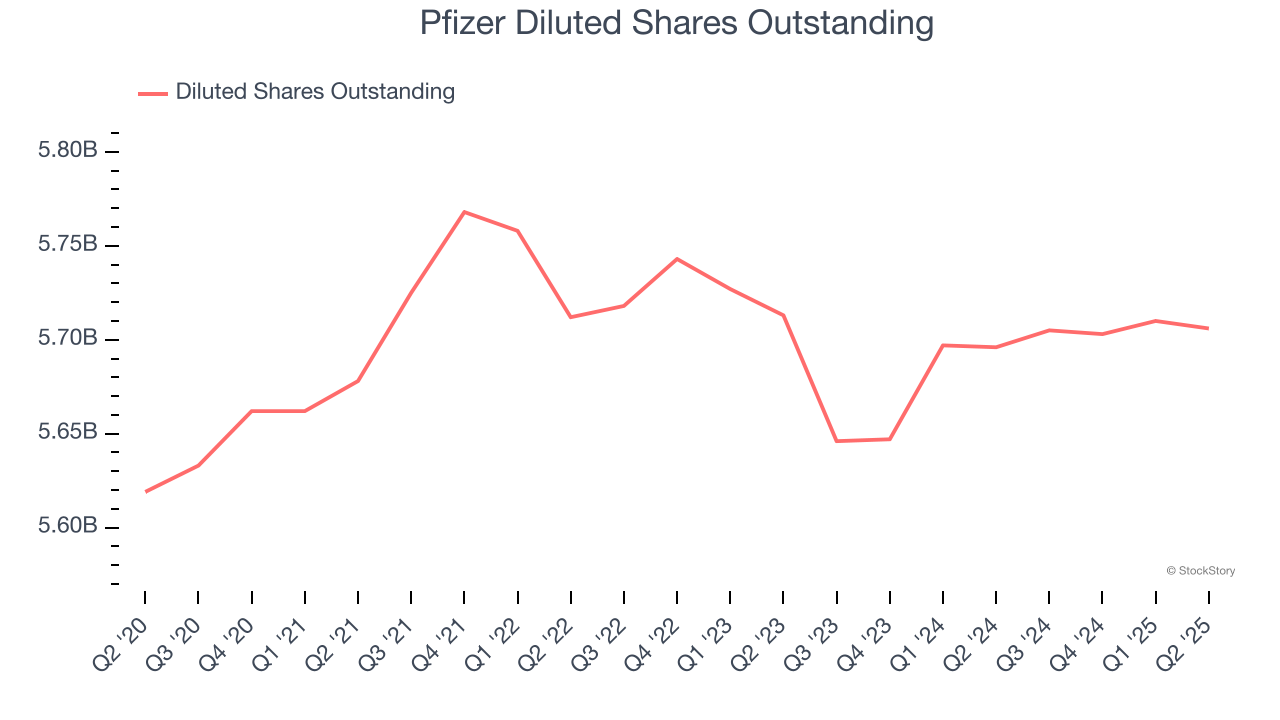

Pfizer’s EPS grew at an unimpressive 3.3% compounded annual growth rate over the last five years, lower than its 8.2% annualized revenue growth. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Diving into the nuances of Pfizer’s earnings can give us a better understanding of its performance. A five-year view shows Pfizer has diluted its shareholders, growing its share count by 1.5%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q2, Pfizer reported adjusted EPS at $0.78, up from $0.60 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Pfizer’s full-year EPS of $3.39 to shrink by 15%.

Key Takeaways from Pfizer’s Q2 Results

We were impressed by how significantly Pfizer blew past analysts’ organic revenue expectations this quarter. We were also excited its EPS outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year EPS guidance was in line. Zooming out, we think this was a solid print. The stock traded up 1.9% to $23.99 immediately after reporting.

Pfizer had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.