Safety certification company UL Solutions (NYSE:ULS) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 6.3% year on year to $776 million. Its GAAP profit of $0.45 per share was in line with analysts’ consensus estimates.

Is now the time to buy UL Solutions? Find out by accessing our full research report, it’s free.

UL Solutions (ULS) Q2 CY2025 Highlights:

- Revenue: $776 million vs analyst estimates of $771.4 million (6.3% year-on-year growth, 0.6% beat)

- EPS (GAAP): $0.45 vs analyst estimates of $0.45 (in line)

- Adjusted EBITDA: $197 million vs analyst estimates of $192.8 million (25.4% margin, 2.2% beat)

- Operating Margin: 17.9%, in line with the same quarter last year

- Free Cash Flow Margin: 13.5%, up from 6.4% in the same quarter last year

- Market Capitalization: $14.64 billion

Company Overview

Founded in 1894 as a response to the growing dangers of electricity in American homes and businesses, UL Solutions (NYSE:ULS) provides testing, inspection, and certification services that help companies ensure their products meet safety, security, and sustainability standards.

Revenue Growth

A company’s top-line performance is one signal of its overall business quality. Strong growth can indicate it’s riding a successful new product or emerging trend.

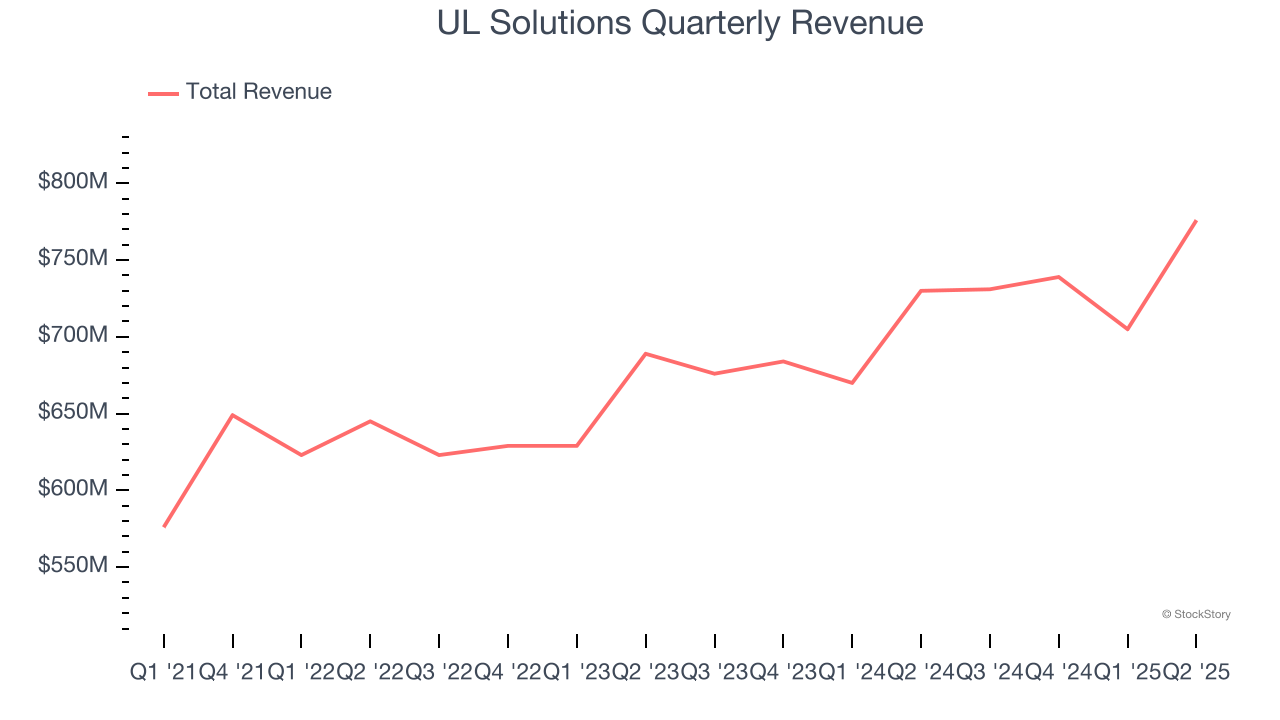

With $2.95 billion in revenue over the past 12 months, UL Solutions is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

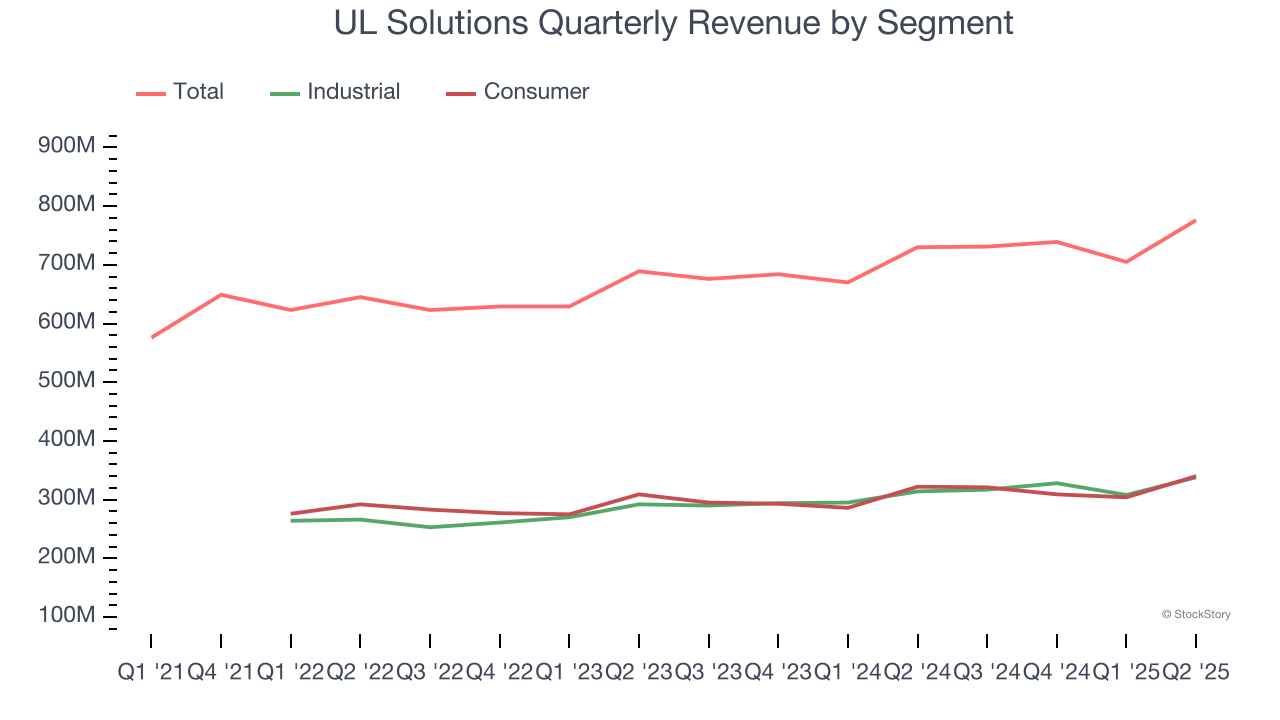

We can better understand the company’s revenue dynamics by analyzing its most important segments, Industrial and Consumer, which are 43.6% and 43.8% of revenue. Over the last two years, UL Solutions’s Industrial revenue averaged 9.6% year-on-year growth while its Consumer revenue averaged 5.5% growth.

This quarter, UL Solutions reported year-on-year revenue growth of 6.3%, and its $776 million of revenue exceeded Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, a slight deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and indicates the market is baking in some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

UL Solutions has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 15.2%.

Analyzing the trend in its profitability, UL Solutions’s operating margin rose by 1.2 percentage points over the last five years, showing its efficiency has improved.

This quarter, UL Solutions generated an operating margin profit margin of 17.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

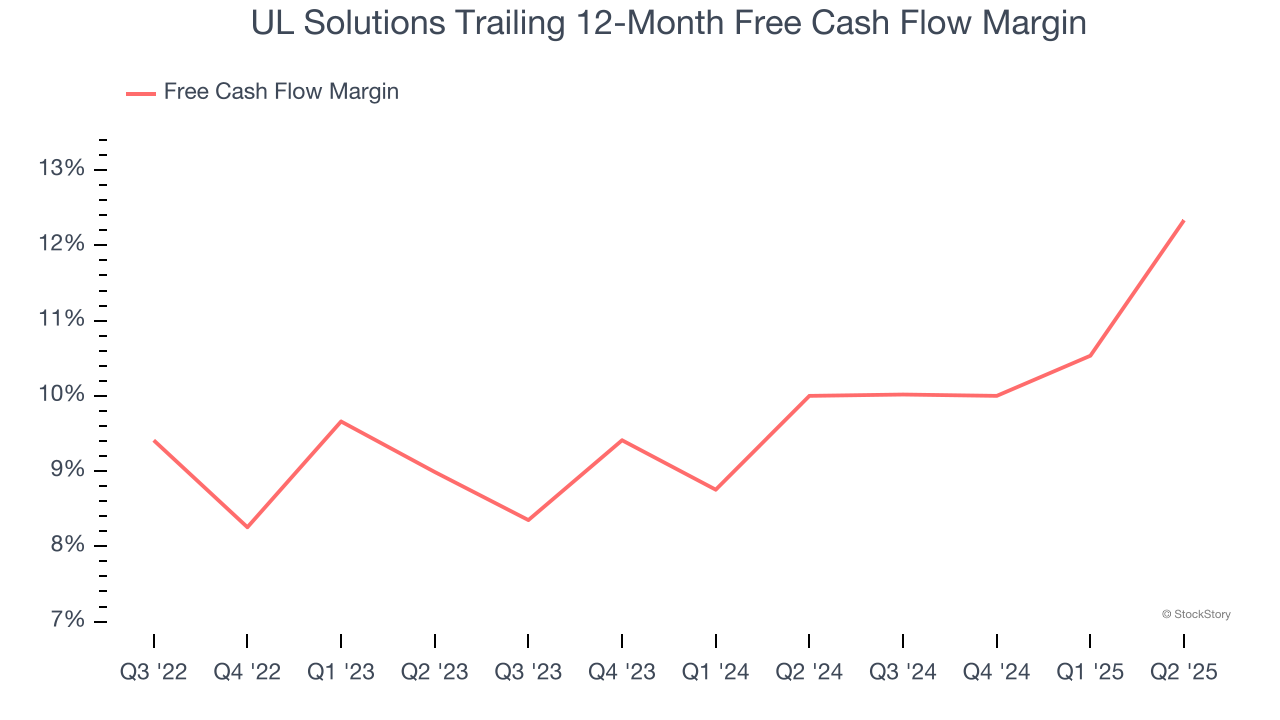

UL Solutions has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.4% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that UL Solutions’s margin expanded by 4.8 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

UL Solutions’s free cash flow clocked in at $105 million in Q2, equivalent to a 13.5% margin. This result was good as its margin was 7.1 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from UL Solutions’s Q2 Results

It was good to see UL Solutions narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS slightly missed. Overall, this was a weaker quarter. The stock traded down 2.3% to $71.40 immediately following the results.

Is UL Solutions an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.