Semiconductor maker Himax Technologies (NASDAQ:HIMX) announced better-than-expected revenue in Q2 CY2025, but sales fell by 10.4% year on year to $214.8 million. Its GAAP profit of $0.10 per share was in line with analysts’ consensus estimates.

Is now the time to buy Himax? Find out by accessing our full research report, it’s free.

Himax (HIMX) Q2 CY2025 Highlights:

- Revenue: $214.8 million vs analyst estimates of $212 million (10.4% year-on-year decline, 1.3% beat)

- EPS (GAAP): $0.10 vs analyst estimates of $0.10 (in line)

- Operating Margin: 8.4%, down from 12.2% in the same quarter last year

- Free Cash Flow Margin: 26.4%, up from 9.3% in the same quarter last year

- Inventory Days Outstanding: 83, up from 79 in the previous quarter

- Market Capitalization: $1.51 billion

“Starting in August, the U.S. began clarifying its tariff measures toward most of the countries, including major economies such as Japan and the EU. These developments have helped reduce uncertainty in the global trade environment. That said, less than 24 hours ago, the U.S. government announced plans to impose tariffs of approximately 100% on semiconductor chips imported from companies that do not manufacture in the United States. As the details of the new tariff plan have yet to be released, we are unable to comment further regarding its potential impact at this time. We are closely monitoring the situation and will respond accordingly. It's worth noting that tariffs have not had a significant direct impact on Himax’s business, as our IC products are not directly exported to the U.S. Instead, they are integrated into panels or modules by customers outside the United States and then sold globally, including into the U.S. market. Only a negligible portion, about 2%, of Himax’s products are shipped directly to the United States,” said Mr. Jordan Wu, President and Chief Executive Officer of Himax.

Company Overview

Taiwan-based Himax Technologies (NASDAQ:HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

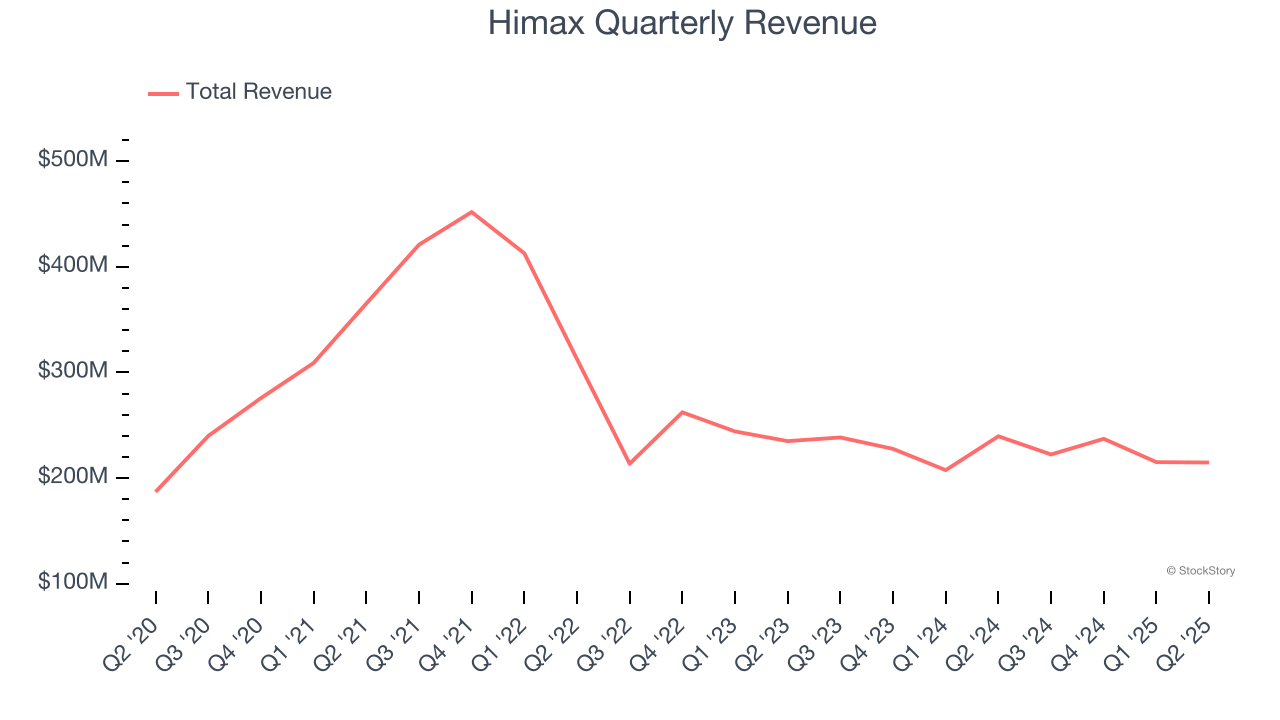

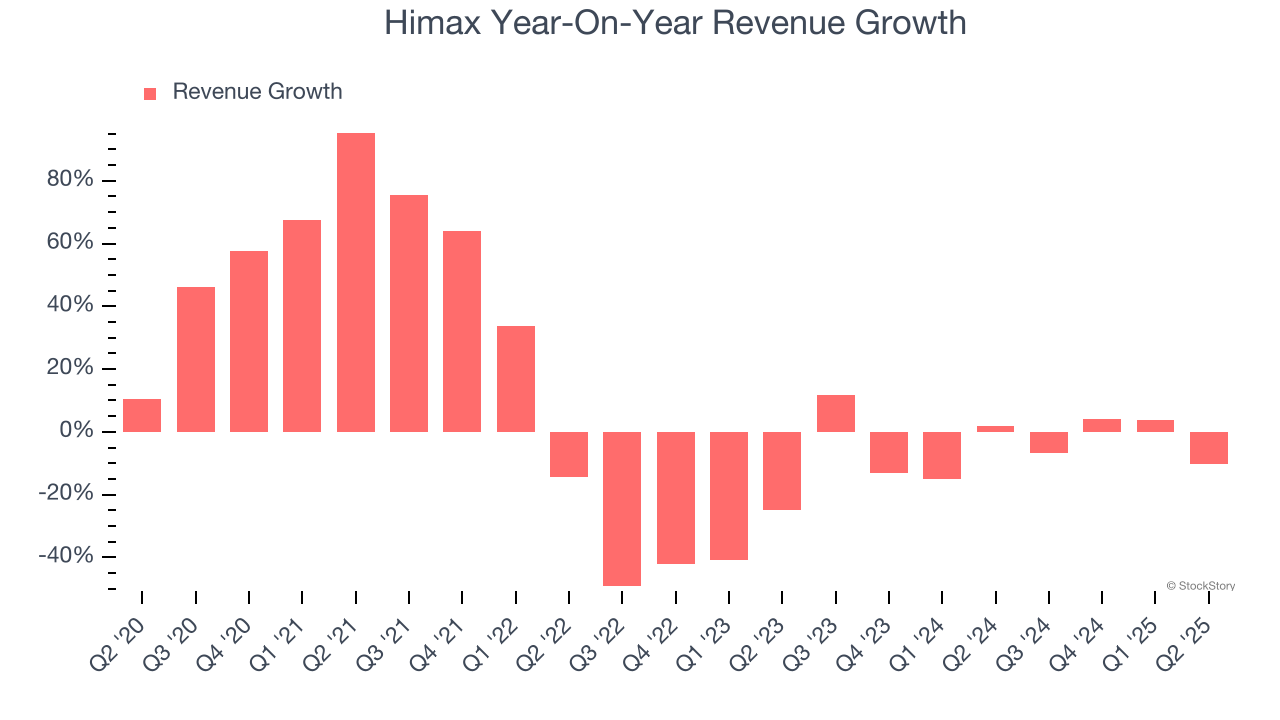

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Himax grew its sales at a tepid 4.6% compounded annual growth rate. This was below our standard for the semiconductor sector and is a rough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Himax’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.5% annually.

This quarter, Himax’s revenue fell by 10.4% year on year to $214.8 million but beat Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to decline by 1.5% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

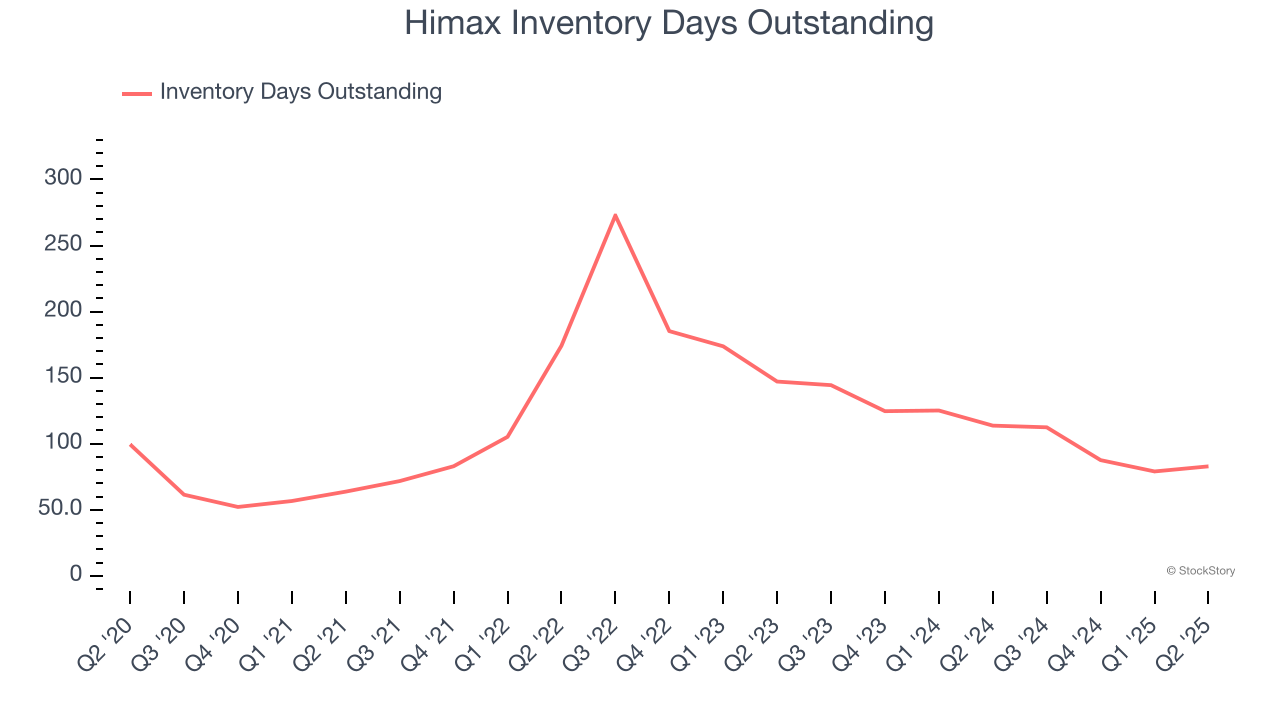

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Himax’s DIO came in at 83, which is 33 days below its five-year average. These numbers show that despite the recent increase, there’s no indication of an excessive inventory buildup.

Key Takeaways from Himax’s Q2 Results

It was good to see Himax narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed and its inventory levels increased. Overall, this quarter could have been better. The stock traded down 16.2% to $7.23 immediately after reporting.

The latest quarter from Himax’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.