Fertility benefits company Progyny (NASDAQ:PGNY) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 9.5% year on year to $332.9 million. Guidance for next quarter’s revenue was optimistic at $297.5 million at the midpoint, 2% above analysts’ estimates. Its non-GAAP profit of $0.48 per share was 12.1% above analysts’ consensus estimates.

Is now the time to buy Progyny? Find out by accessing our full research report, it’s free.

Progyny (PGNY) Q2 CY2025 Highlights:

- Revenue: $332.9 million vs analyst estimates of $320.4 million (9.5% year-on-year growth, 3.9% beat)

- Adjusted EPS: $0.48 vs analyst estimates of $0.43 (12.1% beat)

- Adjusted EBITDA: $57.95 million vs analyst estimates of $52.95 million (17.4% margin, 9.4% beat)

- The company lifted its revenue guidance for the full year to $1.25 billion at the midpoint from $1.21 billion, a 3.5% increase

- Management raised its full-year Adjusted EPS guidance to $1.74 at the midpoint, a 9.4% increase

- EBITDA guidance for the full year is $210 million at the midpoint, above analyst estimates of $199.8 million

- Operating Margin: 7.3%, in line with the same quarter last year

- Free Cash Flow Margin: 15.1%, down from 18.4% in the same quarter last year

- Market Capitalization: $2.01 billion

“The strong second quarter results reflect the continued increase in the pacing of member engagement, as members pursued the care and services they need in order to best address their health and family building goals,” said Pete Anevski, Chief Executive Officer of Progyny.

Company Overview

Pioneering a data-driven approach to family building that has achieved an industry-leading patient satisfaction score of +80, Progyny (NASDAQ:PGNY) provides comprehensive fertility and family building benefits solutions to employers, helping employees access quality fertility treatments and support services.

Revenue Growth

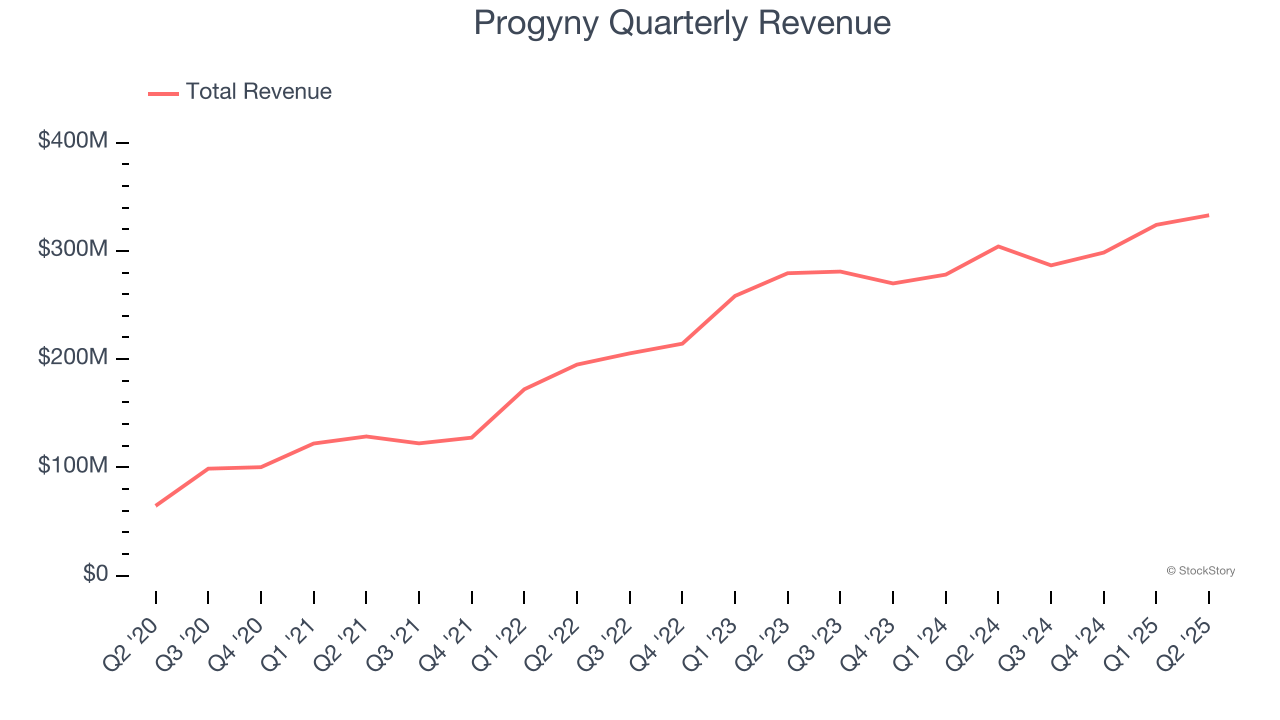

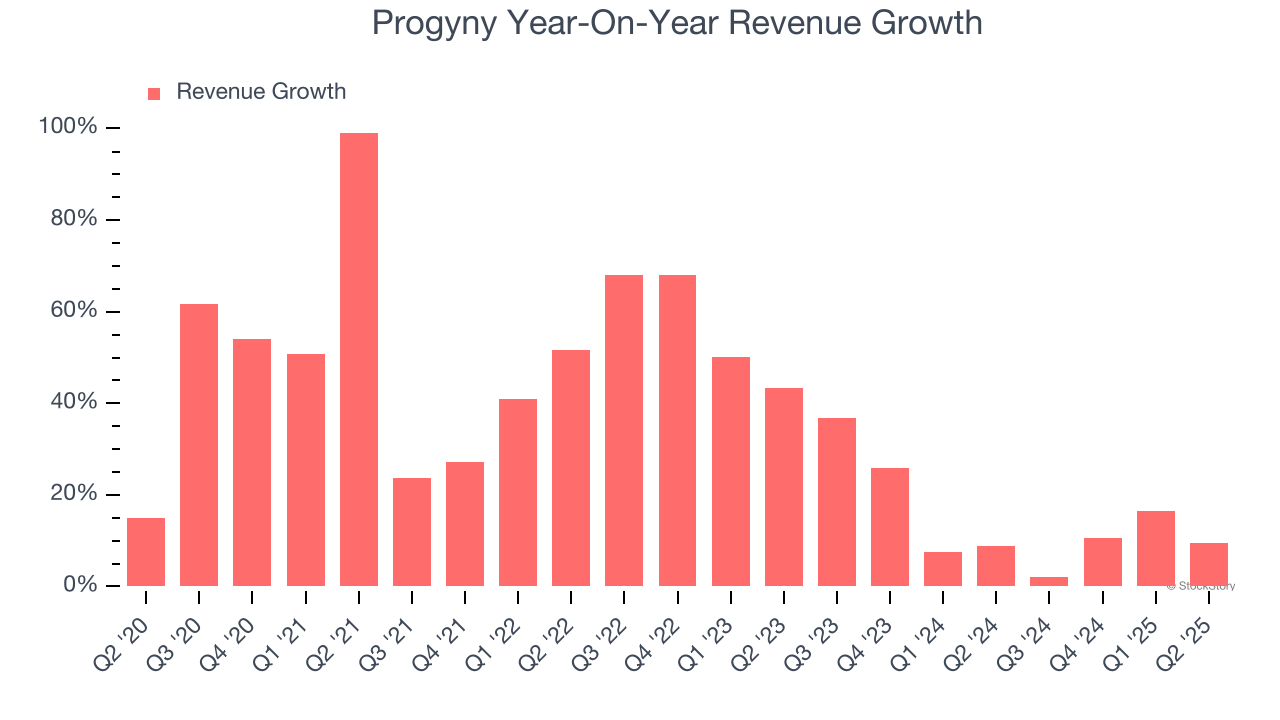

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Progyny grew its sales at an incredible 35.5% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Progyny’s annualized revenue growth of 13.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Progyny reported year-on-year revenue growth of 9.5%, and its $332.9 million of revenue exceeded Wall Street’s estimates by 3.9%. Company management is currently guiding for a 3.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

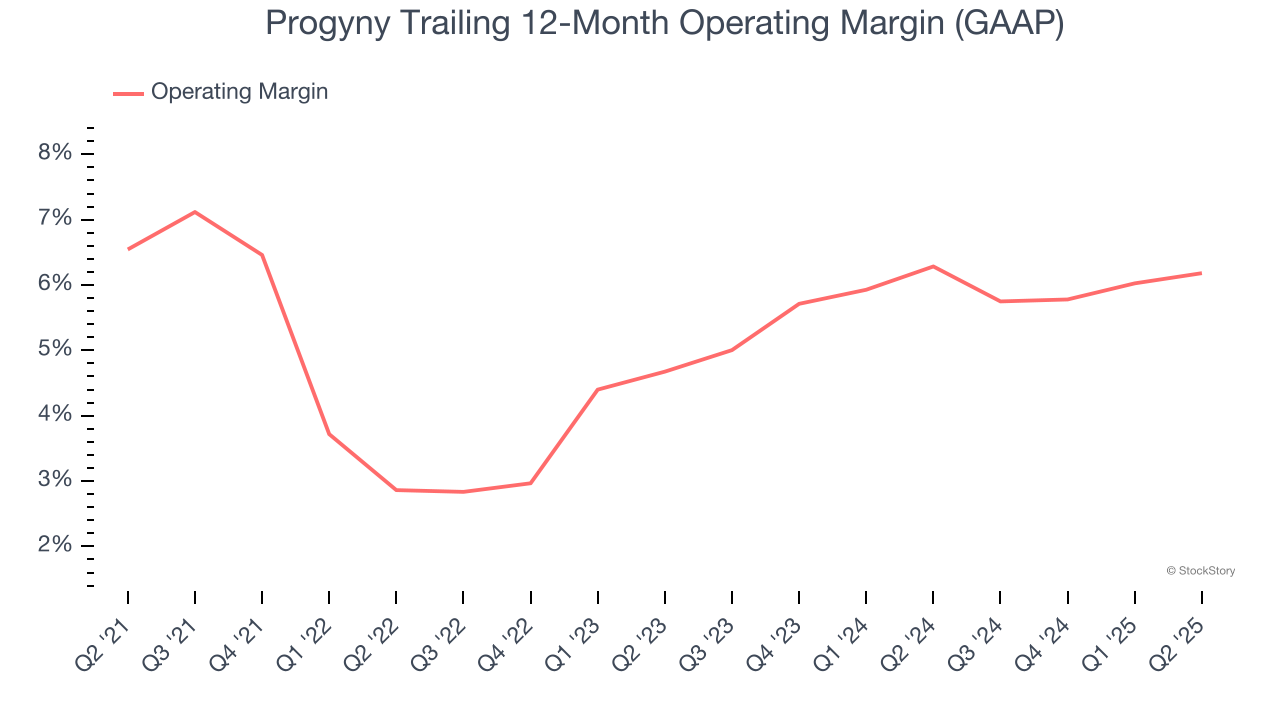

Progyny’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 5.5% over the last five years. This profitability was paltry for a healthcare business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, Progyny’s operating margin of 6.2% for the trailing 12 months may be around the same as five years ago, but it has increased by 1.5 percentage points over the last two years.

In Q2, Progyny generated an operating margin profit margin of 7.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

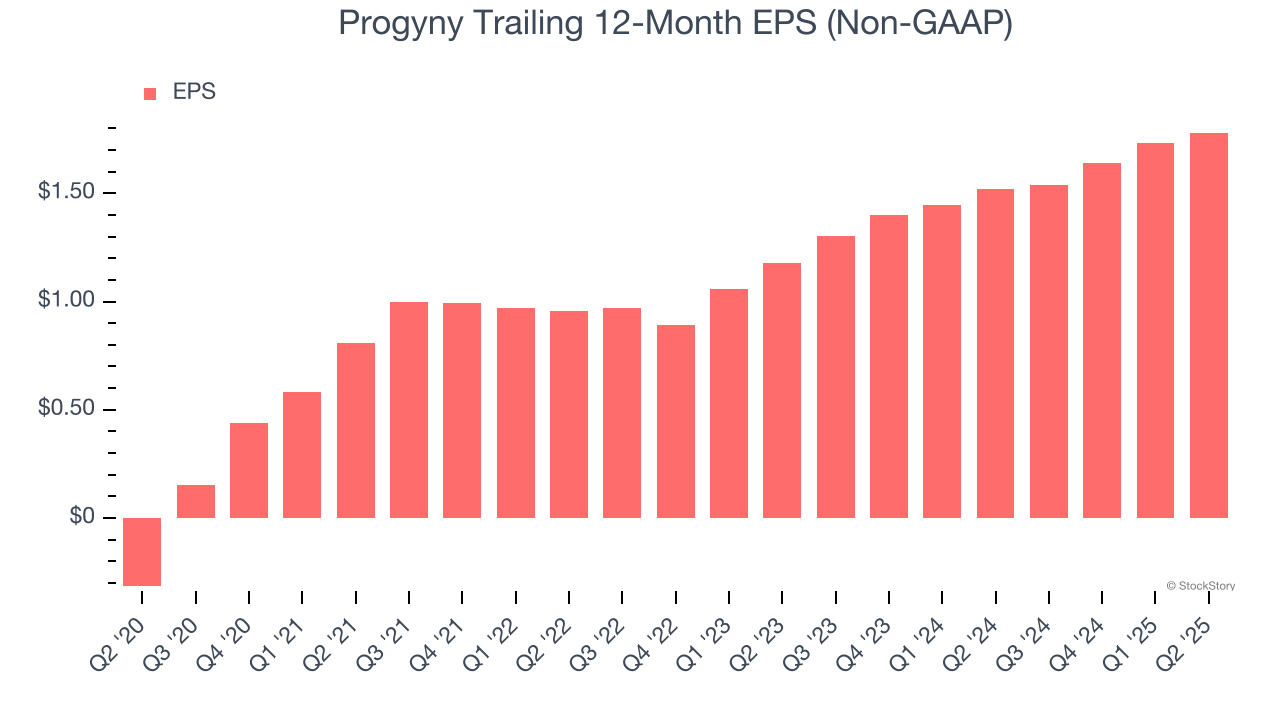

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Progyny’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q2, Progyny reported adjusted EPS at $0.48, up from $0.43 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Progyny’s full-year EPS of $1.78 to shrink by 5.7%.

Key Takeaways from Progyny’s Q2 Results

We were impressed by Progyny’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EPS guidance for next quarter outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 4.3% to $24 immediately following the results.

Progyny had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.