Tesla, Inc. (TSLA)

417.44

+0.37 (0.09%)

NASDAQ · Last Trade: Feb 16th, 8:27 AM EST

Micron stock is enjoying momentum right now as growth investors begin to appreciate the AI memory storage opportunity.

Via The Motley Fool · February 16, 2026

This company is seeing revenue climb in the double digits.

Via The Motley Fool · February 16, 2026

The company's vision of the transportation market is revolutionary, and the company is betting big on it.

Via The Motley Fool · February 16, 2026

Nio and Rivian are both relatively young EV producers, but the market conditions they're faced with could not be more different.

Via The Motley Fool · February 16, 2026

Elon Musk said his $849.3 billion net worth is almost entirely tied to his stakes in Tesla and SpaceX, with less than 0.1% held in cash, as speculation grows about him becoming a trillionaire following SpaceX's merger with xAI and rising odds on Kalshi.

Via Benzinga · February 15, 2026

It's an easy way to quickly own 150-plus companies growing at a solid clip.

Via The Motley Fool · February 15, 2026

Though President Donald Trump's tariff and trade policy may garner the headlines, something more fundamental is at risk of derailing this high-flying stock market.

Via The Motley Fool · February 15, 2026

This week featured major business and political developments, including Tesla's semi pricing undercutting competitors, the Trump administration's rollback of EPA regulations, the Pentagon's addition of Alibaba and BYD to a Chinese military list, Ford's $7 billion EV charge forecast, and Waymo's potential $2.5 billion deal with Hyundai.

Via Benzinga · February 15, 2026

Tesla's core EV business appears to be hitting a wall, forcing it to accelerate the developmental timelines of several of its side projects.

Via The Motley Fool · February 15, 2026

Elon Musk predicts Tesla will have the biggest autonomous vehicle fleet in the future, aligning with their long-term goals and investments in AI.

Via Benzinga · February 15, 2026

Tesla actively recruits AI chip designers in South Korea, aligning with its vision to lead in chip production.

Via Benzinga · February 15, 2026

Can Lucid follow Tesla's growth trajectory?

Via The Motley Fool · February 15, 2026

These stocks trade at about the same price tag as the S&P 500.

Via The Motley Fool · February 15, 2026

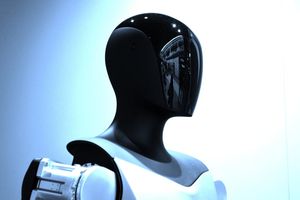

Cathie Wood and ARK Invest see Tesla's Optimus robot as a transformative force for industry, homes, and the broader economy.

Via Benzinga · February 14, 2026

Investors are anticipating big things from Tesla.

Via The Motley Fool · February 14, 2026

Will Rivian replicate Tesla's recent success?

Via The Motley Fool · February 14, 2026

Here is a rare investor chance to scoop up shares of arguably the best auto stock at a discount. Here's why you don't want to miss out.

Via The Motley Fool · February 14, 2026

Retail investors talked up five hot stocks this week (Feb. 9 to Feb. 13) on X and Reddit's r/WallStreetBets, driven by retail hype, earnings, AI buzz, and corporate news flow.

Via Benzinga · February 14, 2026

The eVTOL company is preparing for certification in 2026 and also playing the long game in developing autonomous eVTOL, with the help of Nvidia.

Via The Motley Fool · February 14, 2026

Tesla stock was higher on Friday, a notable divergence as Big Tech led a sharp selloff with investors debating whether the AI spending boom is starting to pressure near-term profits.

Via Talk Markets · February 13, 2026

On Feb. 13, 2026, an earnings beat, strong 2026 delivery outlook, and R2 launch plans sharpened the market's focus on Rivian's growth path.

Via The Motley Fool · February 13, 2026

Starting Sunday, users can only subscribe to full self-driving technology for $99/ month.

Via Stocktwits · February 13, 2026

A congresswoman owns a stake in Elon Musk's xAI and now owns a stake in Apptronik, a company trying to beat Musk's robotic ambitions.

Via Benzinga · February 13, 2026

Explore the S&P500 index on Friday and find out which stocks are the most active in today's session.chartmill.com

Via Chartmill · February 13, 2026

The sell-off in Oracle and Netflix is making aspirations to join the $1 trillion club increasingly distant.

Via The Motley Fool · February 13, 2026