iShares MSCI USA Min Vol Factor ETF (USMV)

95.15

+0.32 (0.34%)

NYSE · Last Trade: Oct 4th, 6:35 PM EDT

September's stock slump has a history. This year, ETFs like SPY, TLT, and VIXY could be at the center as investors hedge against rising volatility.

Via Benzinga · August 29, 2025

Trump's 15% tariff on South Korea imports and $350B investment promise are shaking up ETF market. Look for gains in US infrastructure, industrials, semiconductors, and energy sectors.

Via Benzinga · July 31, 2025

A rare warning signal has reappeared in the market, with a low bull-bear spread and high investor indecision.

Via Benzinga · July 21, 2025

Wall Street's rally faces technical hurdles, with S&P500 and top tech players showing signs of weakness. Market could slump before rebounding.

Via Benzinga · April 25, 2025

JPMorgan's equity strategy: China trade deal, tax cuts, and deregulation may ease tariff concerns, but caution still advised for investors. Buy SPY, QQQ, USMV for upside potential.

Via Benzinga · April 25, 2025

Wall Street has exhibited heightened volatility in recent weeks. Jerome Powell’s recent warnings about severe economic consequences of escalating tariffs have also heightened volatility. Low-volatility ETFs may look appealing in such an environment.

Via Talk Markets · April 19, 2025

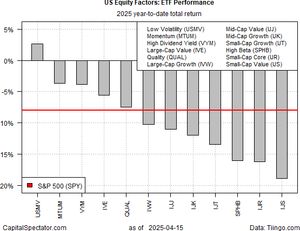

Standing alone among US equity factors this year, the low-volatility strategy is holding on to a modest gain year to date.

Via Talk Markets · April 16, 2025

In this week's video, we'll review the latest charts and data to help us answer the question, are we on the cusp of another global financial crisis?

Via Talk Markets · April 5, 2025

In this week's video, we'll review the latest charts and data to help us understand the good, the bad, and the ugly in the stock market.

Via Talk Markets · March 29, 2025

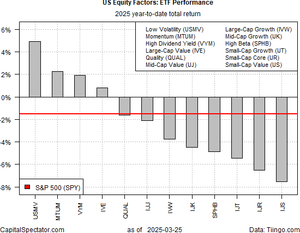

The US stock market is struggling this year, but the low-volatility equity risk premium is still outperforming by a wide margin year to date, based on a set of ETFs.

Via Talk Markets · March 26, 2025

Stocks have been on a roller coaster ride lately as investors struggle to decipher the impact of President Trump’s tariffs.

Via Talk Markets · March 23, 2025

While plummeting stock indexes sent some investors screaming for the exits, others look to shift assets from large-cap tech stocks and cap-weighted ETFs into less volatile investments..

Via Talk Markets · March 16, 2025

Bond market is warning of economic slowdown, causing investors to shift towards defensive assets like ETFs that focus on stability and essential industries.

Via Benzinga · March 10, 2025

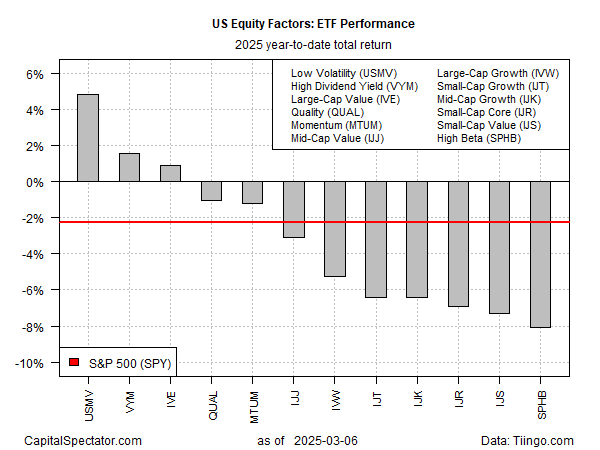

The US stock market has turned negative on the year, but you wouldn’t know it by looking at results for the low-volatility equity risk factor.

Via Talk Markets · March 7, 2025

Markets in turmoil as trade war fears reignite, S&P 500 loses $1.5 trillion. Use VIX to hedge, consider low-volatility ETFs, and follow trends.

Via Benzinga · March 4, 2025

President Trump’s tariff plans as well as signs of economic slowdown have made investors jittery. Investors seeking to remain invested in the equity world may want to consider low-volatility ETFs. Here is a brief overview of some such funds.

Via Talk Markets · March 2, 2025

The global sell-off will result in huge demand for inverse or inverse-leveraged ETFs as these fetch outsized returns on bearish sentiments in a short span.

Via Talk Markets · February 3, 2025

These products could be worthwhile for low-risk-tolerance investors and have the potential to outperform the broader market, especially if volatility persists.

Via Talk Markets · January 13, 2025

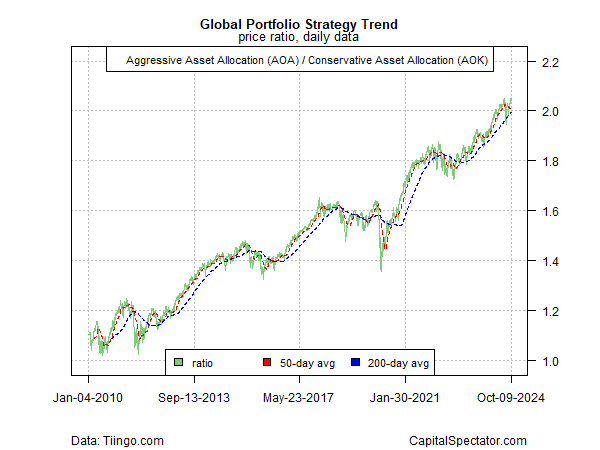

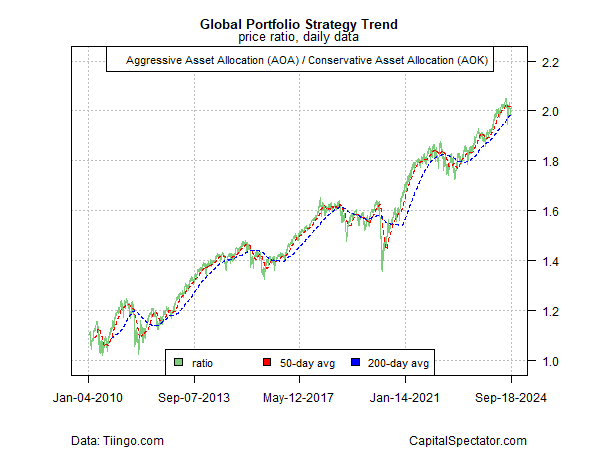

There are many reasons to question a bullish outlook at the start of the year, but the gravity-defying trend remains intact overall.

Via Talk Markets · January 6, 2025

Investor sentiment has wobbled recently, but there’s still room for debate on whether the appetite for risk has peaked for this market cycle.

Via Talk Markets · October 10, 2024

Recent market volatility has raised questions about the staying power of the rally for global assets that began in late-2023.

Via Talk Markets · September 19, 2024

We have highlighted five ETFs from the space that are popular and could be solid options for investors in the current choppy market.

Via Talk Markets · September 6, 2024

We have highlighted five ETFs from the space that have outpaced the S&P 500, which lost 4.1% in a month.

Via Talk Markets · August 15, 2024

From the vantage of the past week of trading the case looks clear for calling recent market volatility a sign of a risk-off pivot.

Via Talk Markets · August 8, 2024

More investors are asking the question lately, in part because markets are seemingly defying gravity and ignoring various macro and geopolitical risks.

Via Talk Markets · July 8, 2024